The healthcare sector in India has witnessed rapid growth in recent years, driven by advancements in medical technologies, rising healthcare awareness, and an increasing prevalence of chronic conditions. One of the key contributors to this expansion is the growing demand for medical devices like disposable catheters. The India disposable catheters market, valued at approximately INR 2,771.29 crore in 2023, is expected to expand further in the coming years. Forecasts suggest that the market will experience a compound annual growth rate (CAGR) of 9.2% from 2024 to 2032, potentially reaching INR 4,668.02 crore by 2032.

This blog post delves into the various facets of the India disposable catheters market, covering key segments, trends, growth drivers, and key players. Additionally, we will discuss how the COVID-19 pandemic has impacted the industry and provide insights into the market’s future outlook.

Overview of the Disposable Catheters Market in India

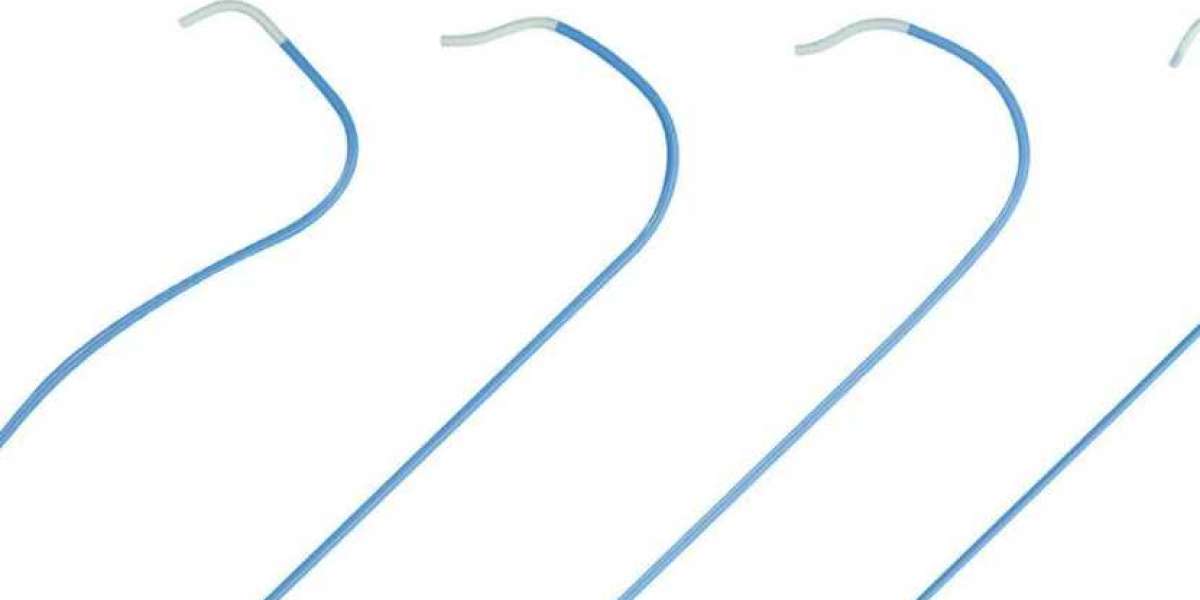

Disposable catheters are thin, flexible tubes that are inserted into the body to facilitate medical procedures, such as draining fluids, delivering medication, or accessing blood vessels. They are commonly used in various medical treatments, including urological, cardiovascular, and neurological procedures. The primary advantage of disposable catheters is that they are designed for single-use, reducing the risk of cross-contamination and infections associated with reusability.

In India, the increasing prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and renal disorders, has significantly contributed to the demand for disposable catheters. Furthermore, improvements in healthcare infrastructure, rising healthcare standards, and government initiatives to promote affordable healthcare solutions have all played a crucial role in boosting market growth.

The market’s growth is also attributed to the growing preference for minimally invasive procedures, where disposable catheters are widely used. These procedures are less invasive than traditional surgeries, leading to faster recovery times and reduced patient discomfort. As more hospitals and clinics adopt advanced technologies, the demand for disposable medical devices, including catheters, is expected to surge.

Get a Free Sample Report with Table of Contents: https://www.expertmarketresearch.com/reports/india-disposable-catheters-market/requestsample

Key Segments of the India Disposable Catheters Market

The India disposable catheters market is diverse, with multiple segments catering to different medical needs. These segments are broadly classified based on product type, application, end-user, and region. Let’s explore each segment in detail:

1. By Product Type

The disposable catheters market is segmented by the type of catheter, with each type serving distinct medical purposes. The major types of disposable catheters include:

Urological Catheters: These catheters are used for draining urine from the bladder. They are commonly used for patients with urinary retention or those undergoing surgeries.

Cardiovascular Catheters: These are used for diagnostic and therapeutic purposes in the cardiovascular system. They are used in procedures like angioplasty and coronary catheterization.

Neurovascular Catheters: These catheters are used in neurological procedures to access blood vessels in the brain and spine.

Intravenous (IV) Catheters: IV catheters are used for delivering fluids, medications, or nutrients directly into the vein.

Specialty Catheters: These include various specialized catheters used in procedures such as dialysis or drainage of bodily fluids from organs.

2. By Application

The application segment further divides the market based on the medical procedure or treatment area where disposable catheters are used. Key applications include:

Urology: This is the largest segment, driven by the increasing number of patients with urinary disorders, kidney failure, and prostatic diseases.

Cardiology: Catheters used in cardiovascular procedures, such as angiography, angioplasty, and stent placement, are gaining significant traction in India.

Neurology: Neurovascular catheters are primarily used in diagnostic and interventional procedures for brain-related disorders.

Other Applications: This includes use in dialysis, surgical operations, and emergency care.

3. By End-User

The disposable catheters market is segmented by end-users, which primarily include:

Hospitals: The largest segment, as hospitals are the primary locations for catheter-based procedures.

Clinics: Smaller healthcare providers, including specialty clinics and day-care centers, are also key consumers of disposable catheters.

Ambulatory Surgical Centers (ASCs): With the rise in outpatient procedures, ASCs are becoming an increasingly important market for disposable catheters.

Home Care: There is a growing trend towards home-based healthcare, especially for elderly patients requiring catheterization. Disposable catheters designed for home use are gaining popularity.

4. By Region

The India disposable catheters market can be divided into regions, such as:

- North India

- South India

- West India

- East India

Each region has its own healthcare infrastructure, patient demographics, and levels of market adoption. The southern and western parts of India, which have more developed healthcare facilities, dominate the market.

Market Trends in the India Disposable Catheters Market

Several trends are shaping the disposable catheters market in India. These trends reflect the evolving healthcare landscape, technological innovations, and changing patient needs. Some key trends include:

1. Growing Preference for Minimally Invasive Procedures

Minimally invasive procedures are gaining popularity across various medical fields due to their numerous benefits, including shorter recovery times, fewer complications, and reduced healthcare costs. Disposable catheters play a vital role in such procedures, particularly in urological, cardiovascular, and neurological surgeries.

2. Technological Advancements

The disposable catheters market is witnessing a shift towards technologically advanced products. Catheters with coatings such as hydrophilic and antimicrobial coatings are gaining traction due to their ability to reduce friction and prevent infections. Innovations in catheter design, such as those with better flexibility and steerability, are also expected to drive market growth.

3. Rising Geriatric Population

India’s aging population is another significant driver of the disposable catheters market. Elderly individuals are more likely to suffer from chronic conditions such as diabetes, cardiovascular diseases, and renal failure, all of which require the use of catheters. As the geriatric population grows, the demand for disposable catheters will continue to rise.

4. Increasing Focus on Infection Control

Infection control is a major concern in hospitals and healthcare settings. Disposable catheters help mitigate the risk of cross-contamination and hospital-acquired infections (HAIs). Hospitals and healthcare facilities are increasingly opting for single-use, sterile catheters to ensure patient safety and improve hygiene standards.

5. Healthcare Infrastructure Development

The development of healthcare infrastructure in both urban and rural areas of India has been a key factor driving the market. Government initiatives and the expansion of private healthcare facilities have increased the accessibility of advanced medical devices, including disposable catheters.

COVID-19 Impact on the Disposable Catheters Market

The COVID-19 pandemic had a profound impact on the healthcare sector, including the disposable catheters market. Initially, the pandemic led to a decrease in elective medical procedures as hospitals were focused on treating COVID-19 patients. This, in turn, temporarily reduced the demand for disposable catheters in 2020.

However, as the pandemic continued and hospitals adapted to new protocols, there was a shift towards maintaining patient safety through the use of single-use medical devices. This has led to a renewed interest in disposable catheters, especially those designed for use in high-risk patients, such as those with renal failure or requiring ICU support.

Moreover, the pandemic accelerated the adoption of home healthcare solutions, including home dialysis, which has contributed to the growing demand for home-use disposable catheters.

Key Players in the India Disposable Catheters Market

Several global and regional players are operating in the India disposable catheters market. These key players focus on expanding their product portfolios, technological innovations, and strategic partnerships to gain a competitive edge. Some of the major companies in the market include:

B. Braun Melsungen AG: A leading player in the global catheter market, B. Braun offers a wide range of disposable catheters for various applications.

Medtronic PLC: Medtronic is one of the largest medical device companies in the world, offering a variety of catheters for cardiovascular, urological, and other applications.

Johnson Johnson: Through its subsidiary Ethicon, JJ is a significant player in the global disposable catheter market.

Boston Scientific Corporation: Boston Scientific is known for its innovative catheters used in cardiovascular procedures.

Cook Medical: Cook Medical offers a broad portfolio of disposable catheters, including those for vascular, urological, and gastrointestinal applications.

Terumo Corporation: A key player in the disposable catheter market, Terumo offers products primarily for cardiovascular procedures.

Coloplast A/S: Specialising in urology and continence care, Coloplast provides disposable catheters designed for both hospital and home use.

Market Outlook and Growth Opportunities

The India disposable catheters market is expected to continue its upward trajectory in the coming years, driven by several factors, including increasing healthcare awareness, the growing prevalence of chronic diseases, and the demand for minimally invasive procedures.

India's expanding healthcare infrastructure and rising disposable incomes are key enablers of market growth. Furthermore, the increasing adoption of home healthcare services presents significant opportunities for companies to tap into a growing market for home-use disposable catheters.

The market is also poised for growth due to the government's focus on improving healthcare accessibility, especially in rural areas, and its push for affordable medical solutions.

FAQs

1. What is the current size of the India disposable catheters market?

The India disposable catheters market was valued at INR 2,771.29 crore in 2023.

2. What is the projected growth rate of the market?

The market is expected to grow at a CAGR of 9.2% from 2024 to 2032.

3. What are the key drivers of market growth?

Key drivers include the increasing prevalence of chronic diseases, technological advancements, and the growing preference for minimally invasive procedures.

4. Who are the key players in the India disposable catheters market?

Major players include B. Braun, Medtronic, Johnson Johnson, Boston Scientific, Cook Medical, Terumo Corporation, and Coloplast A/S.

5. How has COVID-19 impacted the disposable catheters market?

While the pandemic initially reduced elective surgeries, it has increased the demand for disposable catheters due to infection control measures and a shift toward home healthcare solutions.

Related Trending Reports