Cocoa is one of the most significant agricultural commodities globally, particularly vital to the food and beverage industries, especially in chocolate production. Its price, however, is subject to fluctuations due to several factors including weather patterns, political stability in key producing countries, currency movements, supply and demand dynamics, and global economic conditions. This article will explore the factors influencing cocoa price graph, and provide a forecast for the coming years.

Key Drivers of Cocoa Prices

1. Supply and Demand Dynamics

The fundamental driver of cocoa prices is the balance between global supply and demand. Cocoa beans are grown primarily in tropical regions, with the top producers being Côte d'Ivoire, Ghana, and Indonesia. Any disruptions in supply due to weather conditions, diseases, or political instability can cause cocoa prices to rise.

- Demand for Chocolate and Cocoa Products: The global demand for chocolate, especially in emerging markets like China and India, significantly impacts cocoa prices. As the middle class grows in these regions, consumption of chocolate and cocoa-based products is expected to rise, putting upward pressure on prices.

- Supply Constraints: Cocoa production is often constrained by seasonal weather patterns, pests, and diseases. For example, in major producing countries like Ghana and Côte d'Ivoire, factors like the spread of diseases such as “Black Pod” or unpredictable weather events like droughts or floods can reduce cocoa yields, leading to price hikes.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/cocoa-price-trends/pricerequest

2. Weather Conditions

Cocoa trees are highly sensitive to weather patterns, and changes in temperature, rainfall, and humidity can significantly impact crop yields. The two primary cocoa harvests— the main crop and the smaller mid-crop—are heavily dependent on consistent and favorable weather conditions.

- El Niño and La Niña Events: These weather phenomena, which cause significant shifts in global weather patterns, often result in poor harvests in cocoa-growing regions. A severe El Niño or La Niña event can disrupt production, pushing cocoa prices higher due to lower-than-expected yields.

- Climate Change: Longer-term climate shifts may also play a role in cocoa price volatility, as cocoa production is highly sensitive to temperature and rainfall variability. Increasing temperatures and erratic rainfall patterns may lead to reduced crop quality and lower yields in key cocoa-producing regions.

3. Currency Fluctuations

Cocoa is typically traded in US dollars, meaning that fluctuations in the exchange rates of cocoa-producing countries (such as Côte d'Ivoire and Ghana) against the dollar can influence cocoa prices. A depreciation of the local currency can make cocoa cheaper for buyers in other countries, increasing demand and driving up prices in the global market.

- Currency Devaluation: In countries where cocoa is a major export, currency devaluation can make cocoa beans cheaper in the international market, potentially increasing demand and pushing prices higher.

4. Global Economic Conditions

Cocoa prices are also influenced by broader macroeconomic factors such as inflation rates, global economic growth, and consumer spending. During periods of economic uncertainty, the demand for luxury goods, including chocolate, may decrease, leading to lower cocoa prices.

- Economic Growth in Emerging Markets: The rising middle class in emerging economies, especially in Asia, has spurred increased demand for cocoa. Economic slowdowns in these regions, on the other hand, can dampen demand for cocoa products and lead to price declines.

- Recession or Economic Slowdown: During global recessions or economic downturns, consumers may spend less on luxury goods like chocolate, reducing demand for cocoa and putting downward pressure on prices.

5. Geopolitical Events and Trade Policies

Cocoa is grown predominantly in developing countries, and political instability in key cocoa-producing nations can cause disruptions in supply, leading to price increases. Additionally, trade policies and tariffs imposed by major consuming countries (e.g., the EU or US) can influence global cocoa prices.

- Political Instability in Major Producing Countries: Civil unrest, labour strikes, or changes in government policies in countries like Côte d'Ivoire or Ghana can disrupt the cocoa supply chain, leading to price volatility.

- Trade Barriers: Cocoa tariffs and trade restrictions can also impact cocoa prices by limiting supply or increasing costs for consumers in importing countries.

6. Cocoa Futures Markets

Cocoa is traded on futures markets such as the Intercontinental Exchange (ICE) and the London International Financial Futures Exchange (LIFFE). These markets reflect the future supply and demand expectations and are influenced by speculators, hedge funds, and other financial players.

- Futures Speculation: Speculators in the cocoa futures market can drive prices up or down depending on perceived future shortages or surpluses in supply.

- Market Sentiment: Cocoa prices can also be influenced by investor sentiment and expectations about the future state of the market. For example, if traders anticipate a poor harvest in the coming season, they may bid up prices in the futures markets, which could result in higher spot prices.

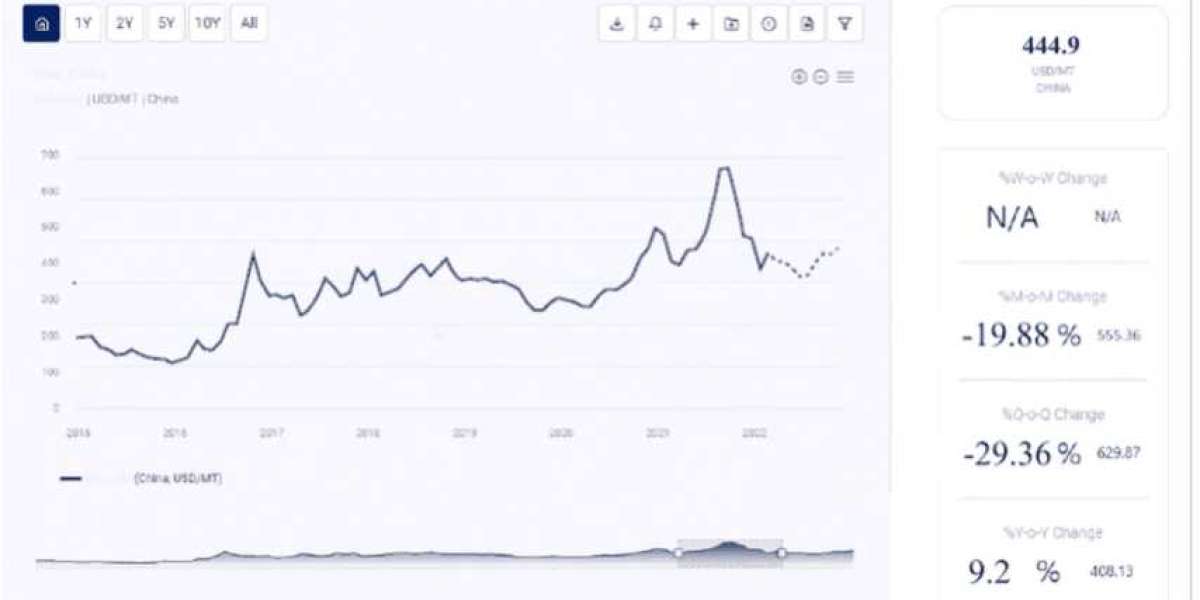

Historical Cocoa Price Trends

2000–2010 (Stable Prices with Periodic Volatility) In the early 2000s, cocoa prices were relatively stable, although they experienced periodic fluctuations due to weather events, regional instability, and global demand shifts. The price of cocoa was around $1,500 per tonne in 2000, and by 2008, it had increased to around $2,500 per tonne. The increase was primarily driven by strong demand and supply concerns from top producers.

2010–2015 (Price Volatility Amid Economic Uncertainty) Cocoa prices saw substantial volatility in this period. The global financial crisis in 2008 and the subsequent economic slowdown impacted the demand for luxury products like chocolate, causing prices to dip in the early 2010s. However, in the latter half of the decade, prices began to rise again due to increased demand from emerging markets and supply disruptions caused by adverse weather conditions in major producing regions.

- 2010-2012: Prices ranged from $2,500 to $3,500 per tonne, driven by rising demand and production shortfalls.

- 2013-2015: Prices continued to experience ups and downs, reaching highs of around $3,700 per tonne, before retreating towards the $2,800 mark.

2016–2020 (Price Surges and Price Drops) During this period, cocoa prices were heavily influenced by a combination of supply-side issues, economic growth in Asia, and speculation on the futures market.

- 2016-2017: Prices were fairly stable, around $2,200 to $2,400 per tonne, with moderate fluctuations.

- 2018–2020: Cocoa prices saw sharp increases, reaching around $2,600 per tonne in 2018 and climbing to over $3,000 per tonne in 2020 due to concerns about supply disruptions in West Africa, adverse weather conditions, and increased demand for chocolate and cocoa products in global markets.

2021–2023 (Price Fluctuations Amid Global Disruptions) The cocoa market witnessed considerable volatility during this period, exacerbated by factors such as the COVID-19 pandemic, supply chain disruptions, and political instability in key cocoa-producing countries. In 2022, cocoa prices spiked above $3,500 per tonne, driven by tight supply and increasing global demand, especially from emerging markets.

- 2021–2022: Prices surged above $3,400 per tonne, with concerns about low production levels in Ghana and Côte d'Ivoire, and global shipping disruptions pushing costs higher.

- 2023: Prices remained volatile but hovered around $3,400 per tonne as the market adjusted to production challenges and fluctuating demand.

Cocoa Price Forecast (2024–2032)

Short-Term Outlook (2024–2026)

In the short term, cocoa prices are expected to remain volatile due to a mix of supply disruptions, weather conditions, and rising global demand, particularly in emerging markets.

Supply Shortages: Any disruptions in cocoa production from major producers due to weather, disease, or political instability could result in upward price pressure.

Demand Growth: As emerging economies continue to grow, demand for cocoa is likely to rise, particularly from Asia and Latin America, supporting higher prices.

Medium-Term Outlook (2027–2029)

In the medium term, the cocoa market could see moderate price growth, driven by increased demand from emerging markets and a gradual recovery of production from the challenges faced in the early 2020s.

- Sustainability Trends: The shift towards more sustainable production practices and better agricultural techniques could help stabilise prices by improving yields and mitigating climate risks.

Long-Term Outlook (2030–2032)

In the long term, cocoa prices may experience steady growth, influenced by population growth, evolving consumer preferences, and ongoing concerns regarding sustainability and climate change. However, technological advances in cocoa farming and increased recycling of cocoa products could help moderate price increases.

- Sustainability Initiatives: More efficient and sustainable cocoa farming techniques, including climate-resistant crops and better agricultural practices, could help reduce price volatility.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA