Small Molecule Innovator CDMO Industry Overview

The global small molecule innovator CDMO market size was estimated at USD 48.6 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.21% from 2024 to 2030. Key drivers for this growth are increasing pharmaceutical RD investment, growing demand for small molecules, and rising incidence of cancer age-related disorders. Biological drugs are more expensive than small molecules. Hence, growing demand for cost-effective drugs is expected to further support market growth.

The COVID-19 pandemic significantly impacted on global economy in 2020 and caused an ongoing impact on various industries. However, the market for contract development and manufacturing organization (CDMO) witnessed a positive impact due to this pandemic. CDMOs played an important role in meeting the needs of pharmaceutical companies, biotech companies, and other end-users during this crisis. Overall, pandemic boosted market demand for small molecule innovator drugs. With the growing demand for outsourcing by pharma companies, heightened demand is observed in post-pandemic scenario.

Gather more insights about the market drivers, restrains and growth of the Small Molecule Innovator CDMO Market

Small Molecule Innovator CDMO Market Segmentation

Grand View Research has segmented the global small molecule innovator CDMO market based on product, stage type, customer type, therapeutic area, and region:

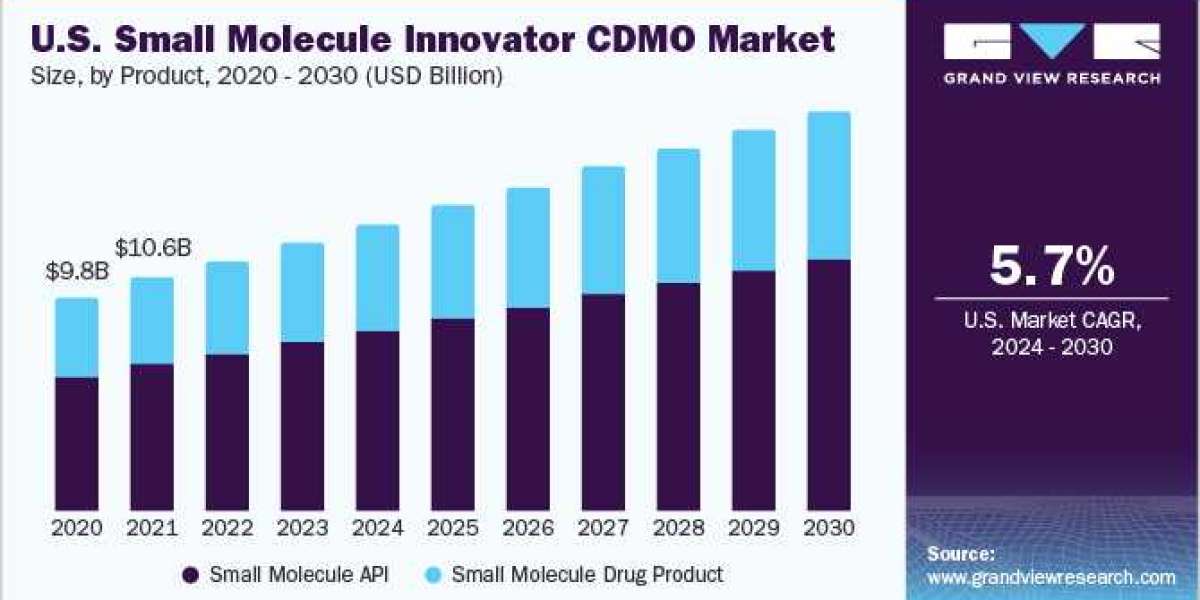

Small Molecule Innovator CDMO Product Outlook (Revenue, USD Million, 2018 - 2030)

- Small Molecule API

- Small Molecule Drug Product

- Oral solid dose

- Semi-Solid Dose

- Liquid Dose

- Others

Small Molecule Innovator CDMO Stage Type Outlook (Revenue, USD Million, 2018 - 2030)

- Preclinical

- Clinical

- Phase I

- Small

- Medium

- Large

- Phase II

- Small

- Medium

- Large

- Phase III

- Small

- Medium

- Large

- Commercial

- Phase I

Small Molecule Innovator CDMO Customer Type Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical

- Small

- Medium

- Large

- Biotechnology

Small Molecule Innovator CDMO Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular disease

- Oncology

- Respiratory disorders

- Neurology

- Metabolic disorders

- Infectious disease

- Others

Small Molecule Innovator CDMO Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- US.

- Canada

- Europe

- UK.

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- India

- Japan

- China

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Browse through Grand View Research's Medical Devices Industry Research Reports.

- The global intrauterine devices marketsize was estimated at USD 6.25 billion in 2023 and is projected to grow at a CAGR of 3.66% from 2024 to 2030.

- The global dual chamber prefilled syringes marketsize was valued at USD 167.3 million in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030.

Key Companies Market Share Insights

Companies are undertaking various strategic initiatives to gain a competitive advantage. Key parameters affecting the competitive nature of the market include acquisition, geographic expansion, mergers, acquisitions, and product launches.

In September 2022, WuXi STA inaugurated a new sterile lipid nanoparticle (LNP) formulation development and manufacturing facility at its Wuxi city campus. The integrated drug product platform CRDMO provides a full range of services, including solid-state development, pre-formulation, and clinical to commercial drug product manufacturing.

In June 2022, Lonza inaugurated a new clinical phase development and manufacturing facility in its small molecules site in Bend, Oregon. It is dedicated to manufacturing bioavailability-enhancing spray-dried dispersion (SDD) finished dosage forms and drug product intermediates

List of Key Players of Small Molecule Innovator CDMO Market

- Piramal Pharma Solutions

- CordenPharma International

- Wuxi AppTec

- Cambrex Corporation

- Recipharm AB

- Pantheon (Thermo Fisher Scientific)

- Lonza

- Catalent Inc.

- Siegfried Holding AG

- Boehringer Ingelheim

- Labcorp Drug Development

Order a free sample PDF of the Small Molecule Innovator CDMO Market Intelligence Study, published by Grand View Research.