Condom Industry Overview

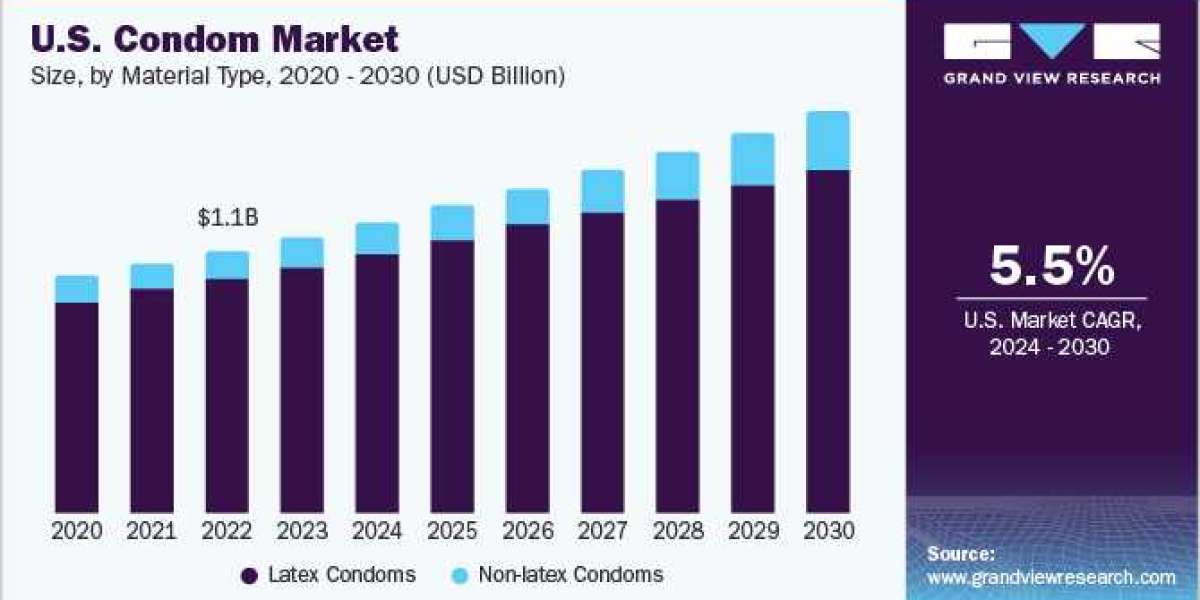

The global condom market size was estimated at USD 11.59 billion in 2023 and is expected to grow at a CAGR of 8.72% from 2024 to 2030. The increase in awareness regarding the use of condoms, measures to reduce the spread of HIV other Sexually Transmitted Infections (STIs), and the availability of different types of products to suit consumer needs are likely to drive market growth during the forecast period.

According to the World Health Organization (WHO) in 2023, approximately 374 million new cases of syphilis, gonorrhea, chlamydia, and trichomoniasis were reported annually. In the same year, WHO reported that 39.0 million people were living with HIV globally, with two-thirds of them residing in the African countries. This can lead to serious complications beyond the immediate effect of the infection itself. If left untreated, STDs can lead to complications such as impotence and infertility. According to a study published on Factors associated with adverse pregnancy outcomes of maternal syphilis in Henan, China, 2016-2022, in 2016, around 1 million pregnant women were detected with active syphilis, which resulted in 200,000 stillbirths and 350,000 adverse birth outcomes. This is expected to boost demand for the use of condoms during the forecast period.

Gather more insights about the market drivers, restrains and growth of the Condom Market

The male condom segment dominated the market with a revenue share of 98.74% in 2023. The growth can be attributed to factors such as manufacturers' focus on the production of male condoms, open-mindedness regarding their use as compared to female condoms, and diverse portfolios. Underdeveloped countries in Africa have a high unmet demand for male condoms due to the increasing prevalence of HIV/AIDS. These are mostly the preferred option among couples, resulting in higher demand.

Moreover, male condoms have a variety of options in terms of materials, thickness, designs, and colors, which promotes their use. They are commonly used methods of contraception. According to the U.S. Census data and Simmons National Consumer Survey data, around 33.44 million Americans used condoms in 2020. This is anticipated to drive the segment growth during the forecast period.

The female condom segment is estimated to witness the fastest CAGR during the forecast period. These are being increasingly accepted for reducing the risk of STIs and unplanned pregnancies. Despite female condoms being a lifesaving product and easy availability, their distribution use are quite low as most of the family planning and HIV prevention programs have not embraced female condoms. However, female condoms are gaining immense popularity of late, especially among single women.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- The global intrauterine devices market size was estimated at USD 6.25 billion in 2023 and is projected to grow at a CAGR of 3.66% from 2024 to 2030.

- The global dual chamber prefilled syringes market size was valued at USD 167.3 million in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030.

Key Condom Company Insights

The market is highly competitive, with the presence of multiple major players. The market is witnessing the presence of numerous country-level players, alongside the introduction of smaller competitors poised to gain a substantial market share. This trend is reflective of the competitive landscape in the industry. Some emerging players in the market are, Jems and Slipp in Canada, Bleu in India, Get Down and Jonny in Australia, and Hanx in the UK.

Key Condom Companies:

The following are the leading companies in the condom market. These companies collectively hold the largest market share and dictate industry trends.

- FUJILATEX CO.,LTD

- Reckitt Benckiser Group PLC

- Church Dwight Co., Inc.

- Karex Berhad

- LELO iAB

- Lifestyles

- Veru Inc.

- Okamoto Industries, Inc

- MAYER LABORATORIES, INC.

- Cupid Limited

- RITEX GMBH

- Pasante Healthcare Ltd.

- CPR GmbH

- Mankind Pharma

- Sagami Rubber Industries Co., Ltd.

- rrtMedcon

Recent Developments

In April 2023, Veru Inc. has entered into a Purchasing Agreement with Afaxys Group Services, LLC (AGS) to offer Veru’s FC2 Female Condom (internal condom) through the AGS Group Purchasing Organization (GPO). This agreement will benefit up to 31 million women and men who depend on community public health centers for essential healthcare.

In May 2021, SKYN, the leading sexual wellness brand and maker of the nonlatex condom, has launched SKYN Excitation, a new condom with a unique wave design featuring raised dots on the most sensitive areas. This new product is set to enhance the sexual experience for those who use it.

Order a free sample PDF of the Condom Market Intelligence Study, published by Grand View Research.