Nuclear Magnetic Resonance Spectroscopy Industry Overview

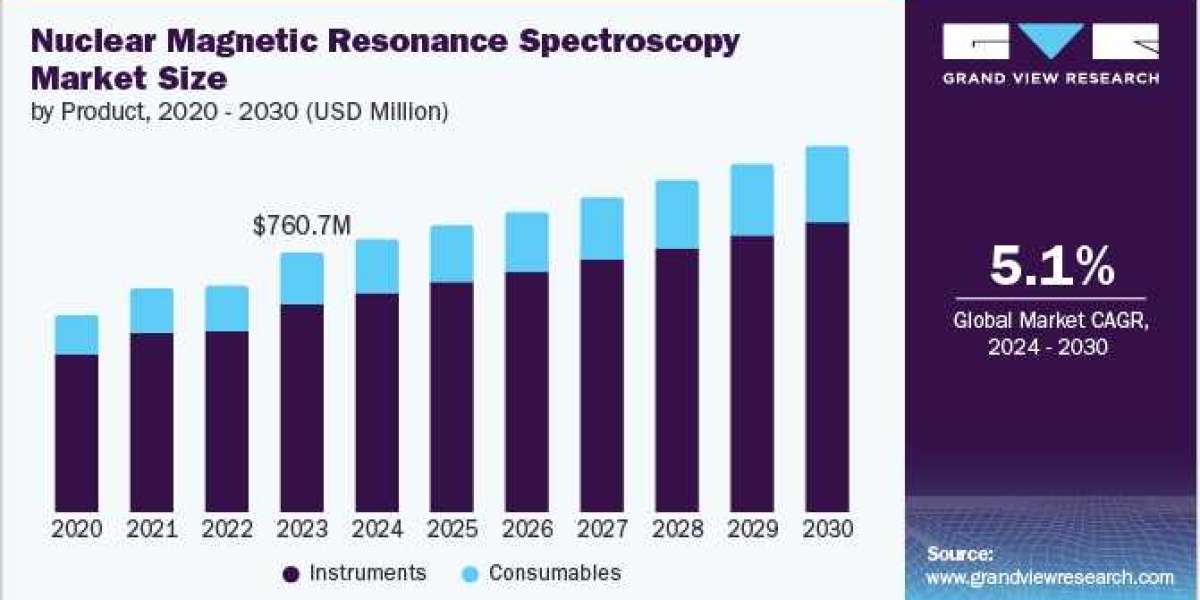

The global nuclear magnetic resonance spectroscopy market size was estimated at USD 760.71 million in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. The market growth is attributed to the increasing funding investment initiatives for nuclear magnetic resonance (NMR) spectroscopy in biomedical research, the rising need for affordable generic medicines, the growing scope of NMR spectroscopy in non-healthcare sectors, and the rising adoption of the technique in medical diagnosis.

NMR spectroscopy is considered an effective method to assess crystalline amorphous pharmaceuticals in the drug and its product. Hence, the development of generic drugs is expected to boost the requirement for NMR spectroscopy. Moreover, the presence of universities, product developers, and pharmaceutical companies’ service providers drives the growth. The essential processes in the pharmaceutical industry are the characterization of drug substances, identifying the structure of crystalline, and observing form conversion during Active Pharmaceutical Ingredient (API) scale-up. Solid-state NMR spectroscopy is considered an analytical tool for investigating multiple crystalline forms in an API and a drug product. Hence, the demand for NMR spectroscopy is anticipated to increase significantly with growing drug development activities.

Gather more insights about the market drivers, restrains and growth of the Nuclear Magnetic Resonance Spectroscopy Market

NMR spectroscopy is advancing its presence in diagnostics through biomedical research, such as studying peptides, proteins, nucleic acids, and amino acids. The technique can analyze the dynamics, structure, and interactions of macromolecules. Hence, increasing research in the biomedical field is anticipated to enhance the use of spectroscopy. According to a report published by WHO in February 2023, the number of funders and their contribution to biomedical research has been growing since 2012. In 2020, approximately 74,702 grants were allotted for biomedical research. The National Institutes of Health contributed the largest grants out of the total granted amount for biomedical research. Hence, the increasing number of grants for biomedical research is anticipated to drive the demand for NMR spectroscopy due to its wide use in biomedical research.

Moreover, several studies have demonstrated promising results for using NMR in metabolomics diagnosis. For instance, a study published by Dove Press in March 2022 reported that serum metabolites can serve as potential diagnostic biomarkers for tumor metastasis. H-NMR spectroscopy was utilized in this study to investigate serum metabolic profiles in a mouse model of colorectal cancer with lung metastasis. Moreover, according to a study published by Intech Open Ltd in February 2018, NMR-based metabolomics contributes to lung cancer diagnosis, even in the early phases of tumor development. Hence, rising metabolomics-based diagnosis for various conditions, such as lung cancer, is anticipated to drive the demand over the forecast period.

Furthermore, the diagnosis of Parkinson’s disease, cancer, infectious and psychiatric disorders has been investigated using NMR spectroscopy. Various companies and academic participants are focusing on metabolomics-based diagnosis using NMR. For instance, in January 2022, the University of Oxford developed a new blood test using NMR metabolomics to identify various cancers. According to an article published by GenomeWeb in October 2021, Lifespin, a metabolomics testing firm, used NMR to develop metabolomics-based diagnostics. The company reported that its scientists had developed NMR-based metabolomic profiles of around 130,000 people, spanning a variety of disorder cohorts, which can help them develop a metabolomics-based diagnosis. Hence, the increasing focus of leading players and academic institutions on NMR for metabolomics diagnosis is anticipated to drive market growth over the forecast period.

However, the high cost of the equipment is anticipated to be a restraining factor for the market's growth.The superconducting nature of magnets increases the cost of this technique. According to the study published by Aston University in September 2023, the cost of large high-field NMR spectrometry instruments can range from USD 0.72 million to USD 12.1 million. Furthermore, the need to regularly supply high-field magnets with cryogenic fluids (He and N2) and the routine hardware maintenance of electronics probes make this technique expensive. In addition, the highly specialized staff is required to operate NMR spectroscopy equipment, which may boost the cost associated with using this technique.

Browse through Grand View Research's Biotechnology Industry Research Reports.

- The global gene delivery technologies market, valued at USD 4.91 billion in 2023, is projected to grow at a CAGR of 11.4% from 2024 to 2030.

- The global optical genome mapping market size was valued at USD 104.1 million in 2023 and is expected to grow at a CAGR of 26.76% from 2024 to 2030.

Key Nuclear Magnetic Resonance Spectroscopy Company Insights

Some of the leading players operating in the market include Bruker, JEOL Ltd., Thermo Fisher Scientific, Inc., and Oxford Instruments. Key players adopt various operating strategies to maintain their market positions. One key strategy is product innovation and differentiation. Moreover, these players emphasize innovation to derive innovation and bring new solutions to the market. The rising demand for technologically advanced products is driving the competition among key players.

QOneTec and ADVANCED MAGNETIC RESONANCE LIMITED are some of the emerging market participants in the market. Emerging players often focus on developing novel products with unique features to differentiate themselves in the market. The companies are focusing on introducing tools that can help in NMR spectroscopy to meet consumer demand, which is expected to drive competition among emerging players.

Key Nuclear Magnetic Resonance Spectroscopy Companies:

The following are the leading companies in the nuclear magnetic resonance spectroscopy market. These companies collectively hold the largest market share and dictate industry trends.

- JEOL Ltd.

- Thermo Fisher Scientific Inc.

- Bruker

- Magritek

- Oxford Instruments

- Nanalysis Corp.

- Anasazi Instruments, Inc.

- QoneTec

- Advanced Magnetic Resonance Limited

Recent Developments

In April 2024, Bruker Corporation unveiled new magnet technology and analytical solutions to enhance the adoption in academic research, clinical studies, and biopharma drug discovery, development, and Process Analytical Technologies (PAT).

In December 2023, Bruker Corporation successfully installed a 1.2 GHz NMR system at Ohio State University’s National Gateway Ultrahigh Field NMR Center. This advanced system would significantly enhance the center’s research capabilities, enabling groundbreaking studies in structural biology, materials science, and related fields by providing unprecedented resolution and sensitivity.

In May 2023, JEOL Ltd. published a paper focusing on an innovative method to determine the mutual orientation of two hydrogens in solid-state NMR. This paper was developed in collaboration with IIT Ropar and Lowa State University. Such publications help researchers and increase awareness about the company’s products during their studies.

Order a free sample PDF of the Nuclear Magnetic Resonance Spectroscopy Market Intelligence Study, published by Grand View Research.