Pharmacy Industry Overview

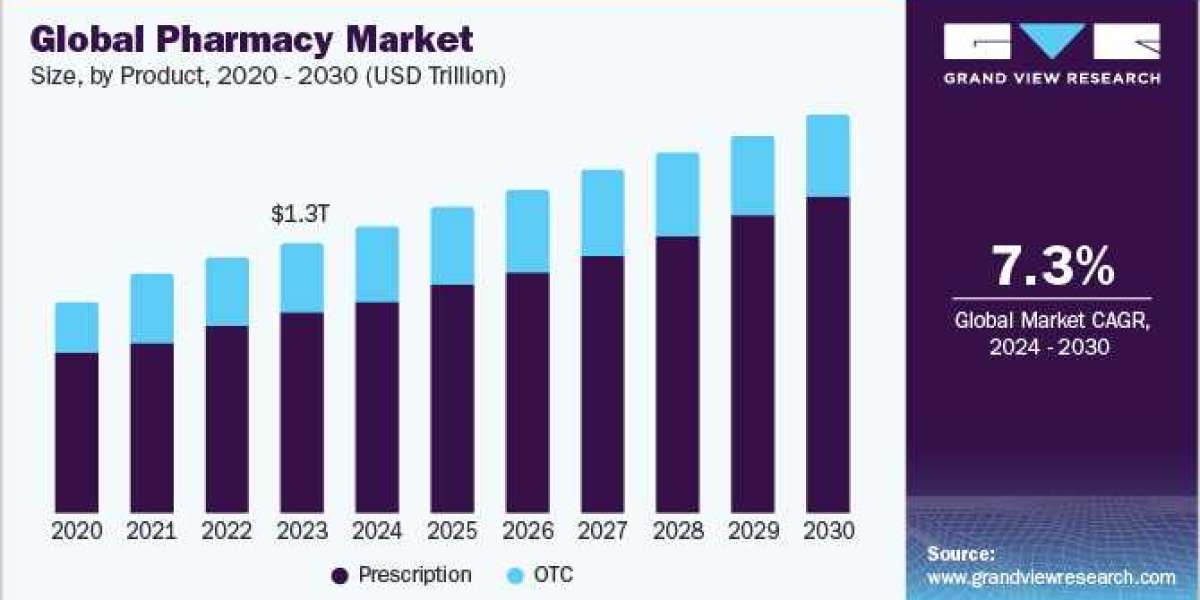

The global pharmacy market size was estimated at USD 1.26 trillion in 2023 and is expected to grow at a CAGR of 7.28% from 2024 to 2030.

The growing demand for specialty drugs globally and increasing prescription drug expenditure in developed countries are expected to drive the growth of the market over the forecast period. In addition, the growing prevalence of chronic diseases, majorly due to changes in lifestyle and a rapidly aging population, are supplementing the market growth.

The growing demand for prescription medications is contributing to the industry's growth. As the demand for prescription drugs increases, pharmacies experience a surge in business due to the need for dispensing these medications. According to the National Health Service the current cost of an NHS prescription in England for 2024-2025 is USD 12.65 per item, an increase of USD 0.51 from the previous year. Prescription charges are usually reviewed annually. The cost has increased steadily in recent years, from USD 8.80 in 2015 - 2016 to USD 10.47 in 2024 - 2025.

Gather more insights about the market drivers, restrains and growth of the Pharmacy Market

Moreover, pharmacies are adopting digitalization programs to cater to the growing demand from consumers and provide improved accessibility to patients. For instance, CVS Health introduced a Digital Transformation program to personalize the healthcare experience using artificial intelligence, machine learning, data, and analytics. Moreover, in December 2021, the company entered into a partnership with Microsoft to scale up retail personalization and loyalty programs using advanced machine learning, powered by Azure. Such digitalization and automation strategies are anticipated to drive the growth in the industry during the forecast period.

Based on product type, the prescription segment dominated the pharmacy market with the largest revenue share of 81.5% in 2023. The increasing demand for prescription drugs for therapies, such as diabetes, cardiovascular disease, respiratory diseases, antibiotics, blood disorders, and oncology, is driving the growth of the prescription segment. Furthermore, the rising prevalence of long-term health conditions and the expanding elderly demographic are fueling the need for prescription drugs.

According to the IDF Diabetes Atlas, 537 million adults were suffering from diabetes in 2021 globally. The number of adults suffering from diabetes is estimated to increase to 783 million by 2045. Almost 90% of older adults regularly take at least one prescription drug, with many taking multiple medications to manage chronic conditions. This growing need for prescription drugs, especially among the aging population, is expected to significantly drive the growth of the industry in the coming years.

However, the OTC segment is estimated to witness the fastest growth rate during the forecast period. The high growth is due to better cost savings compared to prescription drugs, consumer empowerment in managing minor ailments, a shift toward preventive healthcare, an expanding product range, consumer awareness education, and the influence of online sales and e-commerce platforms. In addition, the increasing trend of self-medication and conversion of prescription medicines to OTC medications is expected to contribute to the growth of the segment over the forecast period. For instance, in March 2023, the U.S. FDA approved Narcan (4 mg), a naloxone hydrochloride nasal spray, for OTC use. It is the first-ever naloxone product approved to be used OTC

Browse through Grand View Research's Pharmaceuticals Industry Research Reports.

- The global Crohn’s disease therapeutics market size was valued at USD 13.20 billion in 2023 and is projected to grow at a CAGR of 2.7% from 2024 to 2030.

- The global estrogen receptor positive breast cancer treatment market size was estimated at USD 19.8 billion in 2023 and is projected to grow at a CAGR of 7.89% from 2024 to 2030.

Key Pharmacy Company Insights

Companies in the market are implementing diverse strategies such as partnerships, collaborations, mergers acquisitions, and product development to expand their geographical footprint. CVS Health, Boots Walgreens, Walmart, and Rite Aid Corp. are some major players in the market.

Key Pharmacy Companies:

The following are the leading companies in the pharmacy market. These companies collectively hold the largest market share and dictate industry trends.

- CVS Health

- Boots Walgreens

- Cigna

- Walmart

- Kroger

- Rite Aid Corp.

- Lloyd Pharmacy

- Well Pharmacy

- Humana Pharmacy Solutions

- Matsumoto Kiyoshi

- Apollo Pharmacy

- com

Recent Developments

In January 2024, Kroger extended its partnership with Centene Corporation's pharmacy network. This extension aimed to provide patients with increased opportunities to save on essential prescriptions. The agreement ensured continued access to the Kroger Family of Pharmacies for approximately 700,000 Centene members in 2024.

In April 2023, Rite Aid Corp launched a new three Rite Aid Pharmacies in Craigsville, Greenville, and Scottsville, Virginia. This initiative was part of a pilot program aimed at enhancing access to services in “pharmacy deserts” and underserved communities.

In February 2022, Medicure Inc. subsidiary Marley Drug Pharmacy in the U.S. introduced its national direct-to-consumer ePharmacy platform, which allows Americans to purchase FDA-approved medications at reduced prices and receive home delivery across all 50 states.

In January 2021, AmerisourceBergen and Walgreens Boots Alliance established a strategic partnership. AmerisourceBergen acquired Walgreens Boots Alliance's Healthcare Business, allowing Walgreens Boots Alliance to enhance its emphasis on expanding its retail operations. This collaboration involves extending and broadening their commercial agreements.

Order a free sample PDF of the Pharmacy Market Intelligence Study, published by Grand View Research.