Vitamins Dietary Supplements - Procurement Intelligence

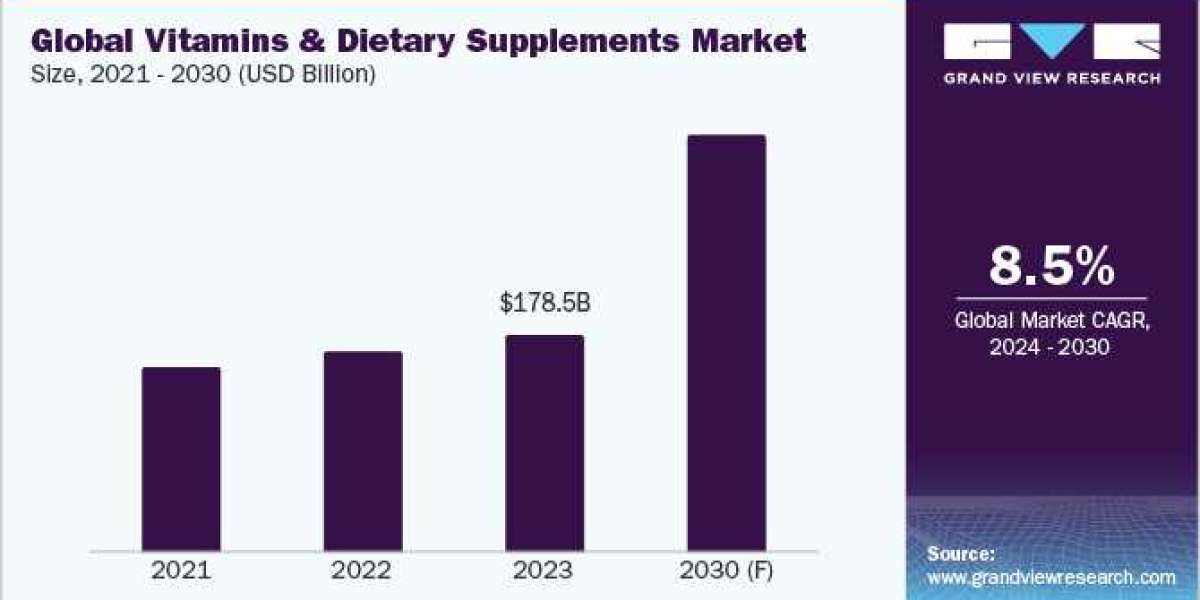

Vitamins dietary supplements procurement is expected to unlock huge opportunities by harnessing advanced technologies across advanced and emerging economies. The global market size stood at USD 178.5 billion in 2023. Traction for health and wellness is evolving among America consumers as they seek supplements tailored to their needs. Notably, North America dominated the industry in 2023, accounting for 35% of the overall market share, followed by Europe and Asia Pacific.

Meanwhile, Europe is anticipated to witness growth owing to increased consumer awareness of health and the role of supplements in weight control and physical activity as well as their readiness to pursue a healthier lifestyle. The Asia Pacific region is poised to observe the fastest growth rate during the forecasted period. This growth is attributed to increasing consumer awareness purchasing power along with a rise in the geriatric population in countries such as Japan and China.

Vitamins dietary supplements are manufactured in several forms, such as tablets, capsules, powders, liquids, and gels. By type, the products are segmented into vitamin subtypes (e.g., A, B, C, D, E, and K), minerals, amino acids, enzymes, and probiotics. The products have end-use applications in pharmaceuticals, nutraceuticals, feed products, foods and beverages, and personal care products. A few of the key raw materials used in manufacturing these products include retinol, carotenoids, thiamin, riboflavin, ascorbic acid, cholecalciferol, calcium carbonate, and magnesium aspartate.

Key technologies driving the growth include nanoencapsulation, biohacking and targeted supplementation, nutrigenomics, 3D printing of capsules, and lab-grown nutrients. For instance, nanoencapsulation provides various benefits, such as improving the stability and solubility of bioactive compounds used in the manufacturing of vitamins and dietary supplements. It also inhibits the deterioration of products during storage and transportation. It also enhances the bioavailability and potency of the target compounds in the products.

Industry players purchase raw materials and active ingredients from a variety of sources and locations. The profit margins are typically moderate to low due to intense competition. The key players usually compete over pricing strategies, product innovations, packaging, labeling, and advertising. Customers can be selective, as their objective is to purchase the best available options at the lowest feasible cost. This increases the pressure on key players to provide competitive pricing and high-quality products. Besides, regulatory guidelines in several countries require companies to have stringent quality control and safety standards.

Vitamins dietary supplements may either be manufactured in-house or through contract development manufacturing organizations (CDMOs). They may be distributed via offline or online distribution channels. Offline channels include brick-and-mortar establishments such as direct sellers, pharmacies, hypermarkets, supermarkets, convenience stores, or other tangible shop environments. Online channels comprise e-pharmacies (Walgreens, CVS, PharmEasy) and e-commerce platforms (Amazon, eBay, Flipkart).

The COVID-19 pandemic caused significant disruption in the global vitamins and dietary supplements industry. The product demand intensified after the COVID-19 outbreak, due to the surge in demand for immunity-boosting products. Supply disruptions were prevalent due to transportation bottlenecks and labor shortages during government-imposed lockdowns, but the supply stabilized significantly in 2023 to meet the increased global demand.

Order your copy of the Vitamins Dietary Supplements Procurement Intelligence report 2024-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Vitamins Dietary Supplements Sourcing Intelligence Highlights

The vitamins dietary supplements market has a fragmented landscape, with intense competition among the service providers.

Countries such as India and China are the preferred low-cost/ best-cost countries for vitamins and dietary supplements owing to cheap raw material costs, cheap labor costs, competitive pricing, and high return on investment.

Buyers have high negotiating power due to the intense competition among the service providers based on the scope of services and prices, enabling the buyers with flexibility to switch to a better alternative.

Raw materials, labor, technology and equipment, energy and utilities, packaging, labeling, and logistics, and other costs are the major cost components of the vitamins dietary supplements. Other costs include RD, regulatory and compliance, rent, general and administrative, sales and marketing, and finance and taxes.

List of Key Suppliers

- Abbott Laboratories

- Amway Corporation

- Archer Daniels Midland Company (ADM)

- BASF SE

- Bayer AG

- DSM Nutritional Products AG

- GlaxoSmithKline plc (GSK)

- Herbalife International, Inc.

- Lonza Group Limited

- Pfizer, Inc.

- American Health Inc.

- RBK Nutraceuticals Pty Ltd.

Browse through Grand View Research’s collection of procurement intelligence studies:

Advertising Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Corn Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Digital Procurement Systems Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Vitamins Dietary Supplements Procurement Intelligence Report Scope

Vitamins Dietary Supplements Category Growth Rate: CAGR of 8.5% from 2024 to 2030

Pricing Growth Outlook: 5% - 10% increase (Annually)

Pricing Models: Cost-plus pricing, competition-based pricing, demand-based pricing, bundled pricing

Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria: Geographical service provision, revenue generated, key regulatory certifications, years in service, employee strength, clientele, product portfolio, key technologies, distribution channels, application/end-use, customer ratings, and others.

Report Coverage: Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model