In recent years, decentralized finance (DeFi) has revolutionized the financial landscape, offering new opportunities for investors to grow their wealth outside traditional financial systems. At the heart of this revolution are two powerful tools: DeFi asset management and structured crypto products. Both play a crucial role in enabling investors to navigate the complex world of digital assets effectively.

Understanding DeFi Asset Management

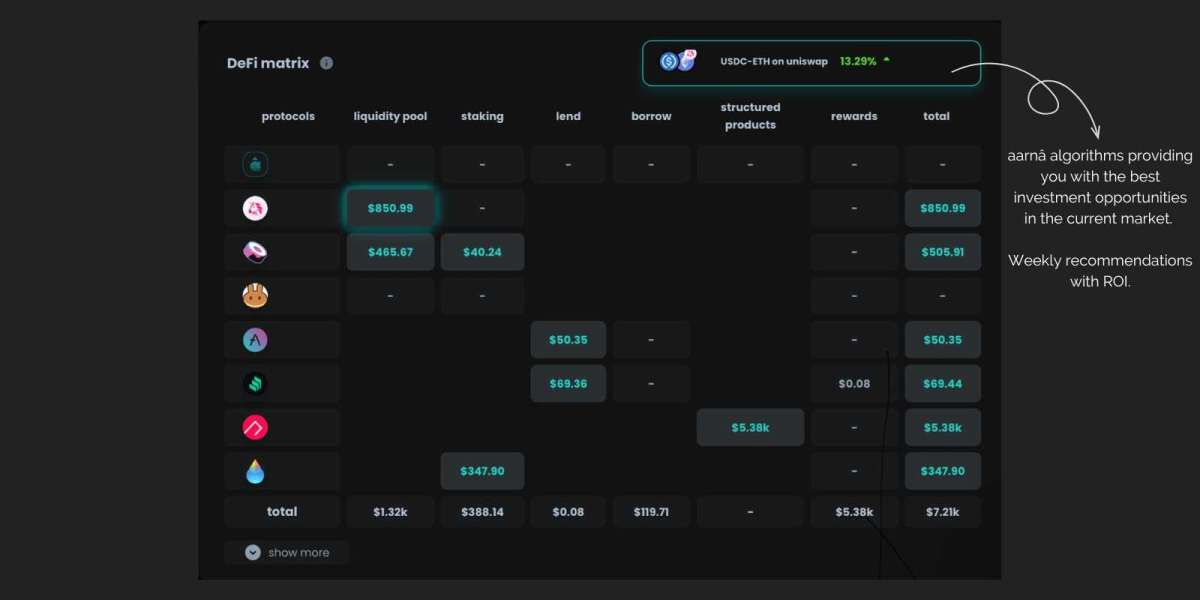

DeFi asset management refers to the process of managing and optimizing a portfolio of digital assets within the decentralized finance ecosystem. Unlike traditional asset management, which relies on centralized institutions, DeFi asset management operates on blockchain technology, ensuring transparency, security, and autonomy for investors. By leveraging smart contracts, DeFi platforms enable users to trade, lend, and earn interest on their assets without intermediaries, reducing costs and enhancing efficiency.

One of the significant advantages of DeFi asset management is the ability to access a wide range of investment opportunities. From yield farming to staking and liquidity mining, DeFi platforms offer various strategies that can be tailored to an investor's risk appetite and financial goals. Moreover, the decentralized nature of DeFi ensures that investors retain control over their assets, minimizing the risk of third-party interference.

Exploring Structured Crypto Products

Structured crypto products are another innovative offering in the DeFi space, designed to provide investors with exposure to digital assets while managing risk effectively. These products are often customized financial instruments that combine different crypto assets, derivatives, or strategies to achieve a specific investment objective. Structured crypto products can range from simple options like fixed-income tokens to more complex offerings such as tokenized baskets of assets or decentralized index funds.

The appeal of structured crypto products lies in their flexibility and potential for enhanced returns. Investors can choose products that align with their risk tolerance, whether they seek capital preservation, income generation, or capital appreciation. Additionally, structured products can be tailored to meet specific market conditions, allowing investors to benefit from various scenarios, including bullish, bearish, or neutral markets.

The Synergy between DeFi Asset Management and Structured Crypto Products

When combined, DeFi asset management and structured crypto products offer a powerful toolkit for investors looking to capitalize on the opportunities within the digital asset space. DeFi asset management platforms can integrate structured products into their offerings, providing investors with a seamless way to diversify their portfolios and access advanced investment strategies. This synergy enables investors to manage risk more effectively while optimizing returns.

For instance, an investor might use a DeFi asset management platform to allocate a portion of their portfolio to a structured product designed to hedge against market volatility. At the same time, they can participate in yield farming or staking activities to generate passive income. This multi-faceted approach allows investors to benefit from the full spectrum of opportunities available in the DeFi ecosystem.

Conclusion

As the digital asset landscape continues to evolve, DeFi asset management will play an increasingly important role in helping investors navigate this dynamic market. By embracing these innovative tools, investors can unlock new avenues for growth, manage risk more effectively, and ultimately achieve their financial goals in the decentralized future of finance. Whether you're a seasoned investor or new to the world of digital assets, exploring the potential of DeFi asset management and structured crypto products is a step towards securing your financial future.