Umami Flavors Industry Overview

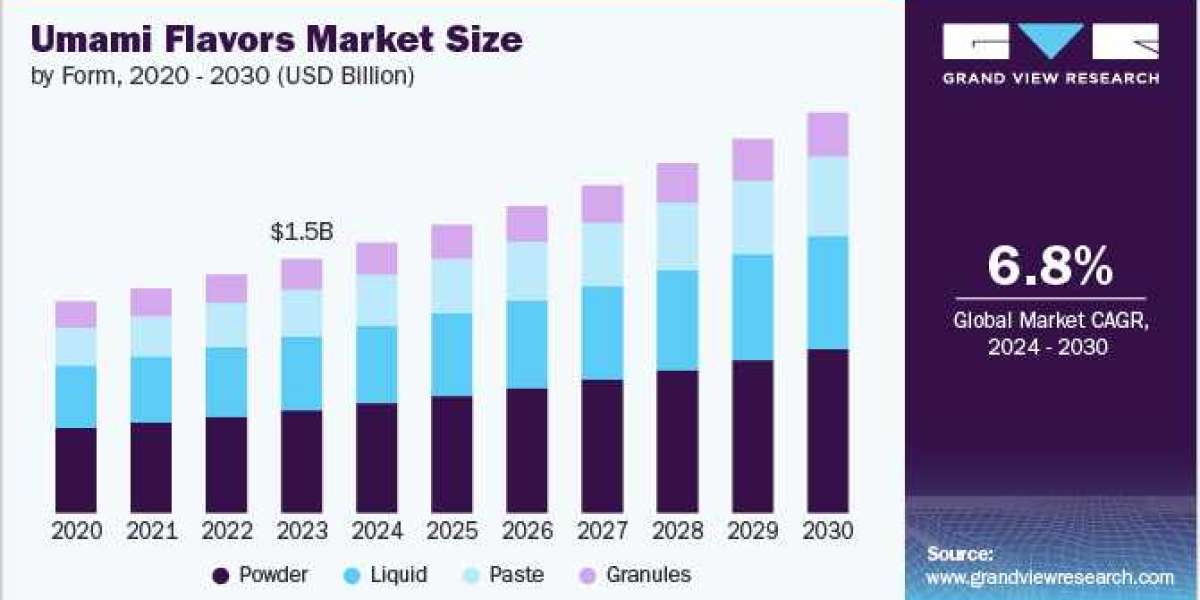

The global umami flavors market size was valued at USD 1.48 billion in 2023 and is expected to grow at a CAGR of 6.8% from 2024 to 2030.

The demand for umami flavors is on the rise, driven by a combination of health and wellness trends. Consumers today are more health-conscious, seeking natural flavor enhancers over artificial additives. Umami flavors, often derived from natural sources like mushrooms, tomatoes, seaweed, and fermented products, fit well with this preference. Additionally, these umami-rich ingredients offer nutritional benefits, providing essential nutrients and antioxidants, which further boost their appeal.

Gather more insights about the market drivers, restrains and growth of the Umami Flavors Market

Culinary innovation and the globalization of food culture are also key factors. The widespread popularity of Asian cuisines, rich in umami flavors, has introduced more people to dishes like sushi, ramen, and miso soup. The rise of gourmet cooking at home and the influence of cooking shows and food blogs have increased awareness and appreciation for umami flavors. Home cooks are now more willing to experiment with new flavors and ingredients, incorporating umami into their culinary repertoire.

In the food industry, product innovation plays a significant role in increasing umami flavor consumption. Food manufacturers are incorporating umami into a wide range of products, including snacks, sauces, and ready-to-eat meals, to enhance taste and appeal. This meets consumer demand for more flavorful and satisfying foods. Additionally, the clean label movement, emphasizing transparency in food ingredients, has led consumers to prefer natural umami sources over synthetic additives.

The sensory appeal of umami flavors is another driving force. Umami enhances the overall taste of foods, making them more palatable and satisfying. This flavor profile is particularly appealing in savory foods and can reduce the need for excessive salt and fat, making products healthier. Umami flavors also increase the feeling of satiety and satisfaction, which can help with portion control and reduce overeating, aligning with the goals of health-conscious consumers.

Market dynamics, including the growing middle-class population and urbanization, further boost demand. The rising middle class, particularly in developing regions, leads to increased consumption of processed and convenience foods that utilize umami for taste enhancement. Busy lifestyles and urbanization drive demand for convenient, ready-to-eat, and ready-to-cook meals, where umami flavors ensure these products are flavorful and appealing despite being processed.

Moreover, cultural and regional preferences play a crucial role. In regions like Asia, umami has always been a central flavor in traditional cuisines. As these culinary practices gain global popularity, the demand for umami flavors follows. The rise of ethnic and fusion foods blending different culinary traditions often incorporates umami-rich ingredients, further boosting their demand. These factors collectively contribute to the growing demand for umami flavors, reflecting broader trends in health, culinary innovation, market dynamics, and cultural preferences.

Browse through Grand View Research's Processed Frozen Foods Industry Research Reports.

- The global plant-based meat market size was valued at USD 7.17 billion in 2023 and is expected to grow at a CAGR of 19.4% from 2024 to 2030.

- The global celtic salt market size was estimated at USD 685.1 million in 2023 and is expected to grow at a CAGR of 6.0% from 2024 to 2030.

Key Companies Market Share Insights

The umami flavors market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in RD and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Umami Flavors Companies:

The following are the leading companies in the umami flavors market. These companies collectively hold the largest market share and dictate industry trends

- Givaudan

- International Flavors and Fragrances, Inc. (IFF)

- Firmenich SA

- Symrise

- MANE

- Takasago International Corporation

- Sensient Technologies Corporation

- Huabao International Holdings Limited

- Cargill, Incorporated

- ADM

Recent Developments

In June 2020, Novozymes, a Danish biotech company, launched an environment-friendly method for producing umami flavorings using enzymes instead of traditional chemical processes. This innovation addresses the challenge of replicating the savory umami taste, which is often associated with cooked meat, in plant-based alternatives. The new enzymatic approach involves breaking down plant proteins like wheat gluten, soybean meal, and pea protein, which are commonly used in meat analogs

Order a free sample PDF of the Umami Flavors Market Intelligence Study, published by Grand View Research.