Chillers Industry Overview

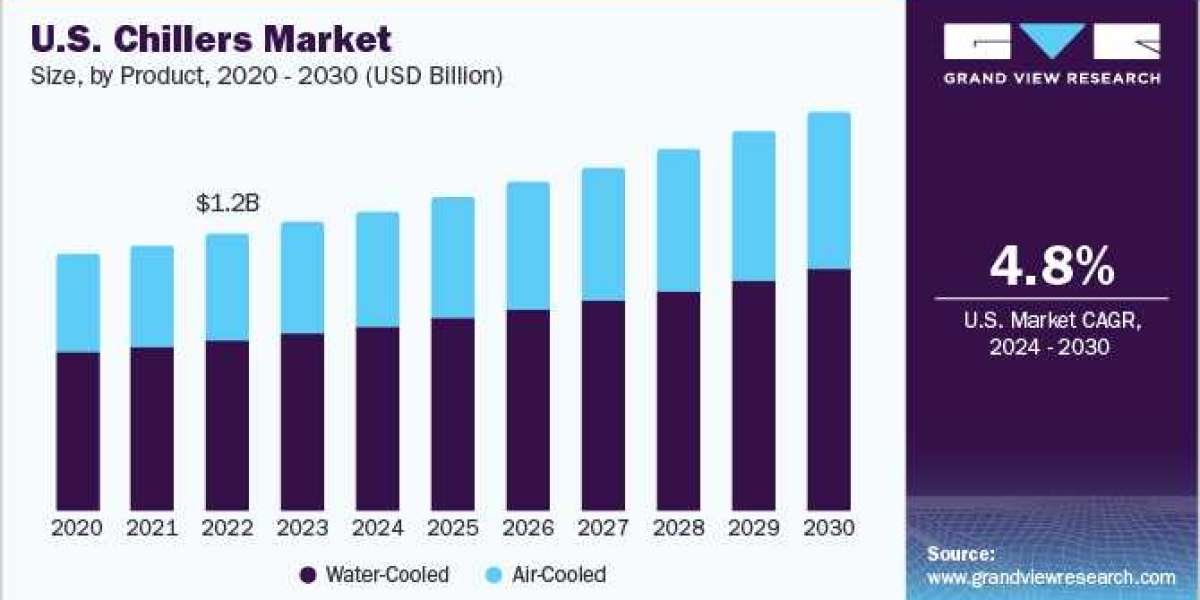

The global chillers market size was estimated at USD 9,928.3 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030.

The market is driven by the rising need for cost-effective and energy-efficient space cooling solutions in commercial and industrial sectors. This, in turn, is expected to augment the demand for the chillers market over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Chillers Market

According to the U.S. Department of Agriculture (USDA), the growing population, rising consumer disposable income, and ongoing urbanization are expected to augment the growth of commercial and residential sector in the country in the forecast period. The demand for chillers in the U.S. residential sectors is driven by a combination of factors, including the need for efficient and reliable air conditioning systems. With a focus on energy efficiency, homeowners are increasingly adopting chillers equipped with advanced technologies and smart controls to ensure precise temperature regulation while minimizing environmental impact. In the commercial sector, the demand for chillers remains robust, particularly in industries such as hospitality, healthcare, and data centres.

Moreover, chillers play a pivotal role in maintaining optimal temperatures for occupant comfort, equipment reliability, and critical processes. The trend towards sustainable building practices and stringent energy efficiency standards further accelerates the adoption of chillers in both residential and commercial applications across the U.S.

The integration of advanced technologies is transforming the global market. Smart chillers, equipped with IoT capabilities, sensors, and predictive maintenance features, allow for remote monitoring and optimization. These technologies enhance overall system efficiency, reduce downtime, and contribute to cost savings. These aforementioned factors are further expected to drive the demand for market over the forecast period.

Global Chillers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global chillers market report based on product, application, compressor type, and region

Product Outlook (Revenue, USD Million, 2018 - 2030)

- Water-Cooled

- 50kW

- 51-100kW

- 101-500kW

- 501-1000kW

- 1001-1500kW

- 1501kW

- Air -Cooled

- 50kW

- 51-100kW

- 101-500kW

- 501-1000kW

- 1001-1500kW

- 1501kW

Application Outlook (Revenue, USD Million, 2018 - 2030)

- Commercial

- Corporate Offices

- Data Centers

- Public Buildings

- Mercantile Service

- Healthcare

- Others

- Industrial

- Chemicals Pharmaceuticals

- Food Beverage

- Metal Manufacturing Machining

- Medical Pharmaceutical

- Plastics

- Others

- Residential

Compressor Type Outlook (Revenue, USD Million, 2018 - 2030)

- Screw Chillers

- Centrifugal Chillers

- Absorption Chillers

- Scroll Chillers

- Reciprocating Chillers

Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- Japan

- India

- Australia

- Thailand

- South Korea

- Indonesia

- Malaysia

- Central South America

- Brazil

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Browse through Grand View Research's Advanced Interior Materials Industry Research Reports.

- The global hardfacing welding market size was estimated at USD 1.73 billion in 2023 and is forecasted to grow at a CAGR of 5.3% from 2024 to 2030.

- The global advanced phase change materials market size was valued at USD 3.01 billion in 2023 and is anticipated to reach a CAGR of 8.2% from 2024 to 2030.

Key Chillers Company Insights

The global market is highly competitive on account of the presence of global and local manufacturers. Companies are engaged in expansion through mergers acquisitions and joint ventures. These companies offer a wide range of systems that are sold through multiple channels, including distributors, company-owned websites, retailers their websites, and e-commerce websites. For instance, in May 2023, Trane acquired MTA, an Italian manufacturer and distributor specializing in industrial refrigeration and air conditioning equipment. This strategic acquisition is expected to enhance Trane's commercial HVAC capabilities, particularly in key markets, by incorporating MTA's process chillers and expanding the rental and services business. With manufacturing sites located in Tribano and Conselve and a workforce of approximately 500 employees, MTA has an annual production capacity of 13,500 systems.

Key Chillers Companies:

The following are the leading companies in the chillers market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps products of these chillers companies are analyzed to map the supply network

- Trane

- Cold Shot Chillers

- Tandem Chillers

- Drake Refrigeration, Inc

- Refra

- Carrier

- FRIGEL FIRENZE S.p.A.

- Midea

- Daikin Industries, Ltd.

- Johnson Controls

- Rite-Temp

- General Air Products

- ClimaCool Corp.

- Fluid Chillers, Inc.

- Multistack International Limited

- Honeywell International, Inc

Recent Developments

In December 2022, Trane unveiled its latest offerings, the water-cooled XStream eXcellent GVWF and air-cooled Sintesis eXcellent GVAF chillers. These innovative chillers incorporate magnetic-bearing compressors and utilize the low global warming potential (GWP) refrigerant R1234ze. Equipped with high-speed centrifugal compressor technology, these chillers deliver larger capacities, wider operating maps to meet challenging European climate conditions, and enhanced seasonal efficiencies, all while maintaining a compact size

In April 2021, refrigeration equipment manufacturer Refra initiated production operations at its newly established facility in Vievis, located in close proximity to the capital city, Vilnius, Lithuania. Spanning an area of 12,000 square meters, the factory is situated approximately 40 kilometers northwest of Refra's headquarters in Vilnius. The expansion has resulted in the creation of employment opportunities for an additional 100 individuals

Order a free sample PDF of the Chillers Market Intelligence Study, published by Grand View Research.