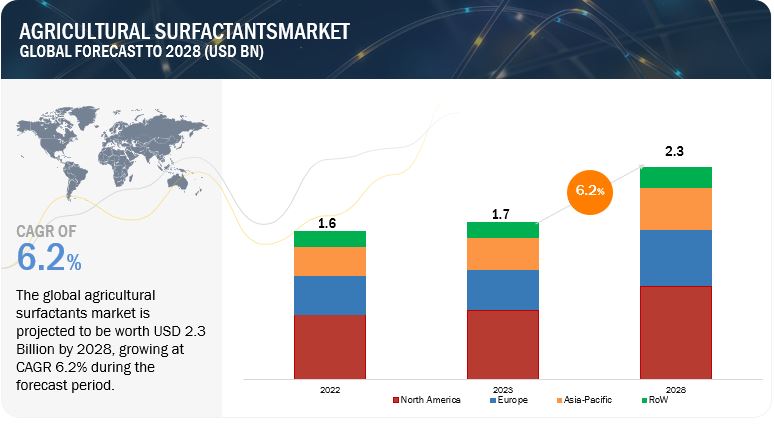

The agricultural surfactants industry was valued at USD 1.7 billion in 2023 and is expected to grow to USD 2.3 billion by 2028, reflecting a CAGR of 6.2% during this period. This market is experiencing notable growth due to several key factors. First, the need to increase crop yields and optimize resource use in response to rising global food demand and climate change is driving the adoption of innovative agricultural practices. Surfactants enhance the effectiveness of pesticides and enable targeted delivery, leading to better crop health and higher yields. Additionally, the growing preference for environmentally sustainable solutions aligns well with the characteristics of surfactants, which typically exhibit lower toxicity and higher biodegradability than traditional chemicals. Moreover, ongoing research and technological advancements are producing more effective surfactant formulations, making them increasingly appealing to farmers and agribusinesses. The trend towards biosurfactants further supports this growth, reflecting a broader shift toward bio-based products. Overall, the increasing recognition of surfactants as essential tools in modern agriculture is driving market expansion and promising future growth.

Agricultural Surfactants Market Drivers: Rise in demand for green solutions

The growing demand for environmentally sustainable solutions is driving significant growth in the agricultural surfactants market. With rising concerns about ecological impacts, farmers and agribusinesses are increasingly looking for greener alternatives to traditional chemical inputs. Agricultural surfactants enhance the effectiveness of agrochemicals and reduce waste, making them a natural fit for the shift toward eco-friendly practices. These surfactants allow for more precise application of pesticides and fertilizers, minimizing runoff and environmental contamination. The emphasis on green solutions is spurring research and development into biodegradable and low-toxicity surfactants, further increasing their appeal. As sustainability becomes a fundamental aspect of modern agriculture, the market is thriving, thanks to its crucial role in promoting environmentally responsible practices.

Agricultural Surfactants Market Opportunities: Production of bio-based surfactant products

The production and adoption of biobased surfactants represent a significant opportunity for growth in the agricultural surfactants market, steering it toward more sustainable practices. Sourced from renewable materials like plant oils and microbes, biobased surfactants meet the rising demand for eco-friendly solutions in agriculture. They provide notable benefits, including enhanced biodegradability, reduced environmental impact, and lower toxicity compared to synthetic alternatives.

As awareness of environmental issues increases, consumers, regulators, and industries are prioritizing sustainability. Biobased surfactants fulfil this need by effectively delivering agrochemicals while minimizing ecological harm. This transition to greener options aligns with modern farming practices, which emphasize precision and minimal disruption to the environment.

With a growing preference for products that have a smaller environmental footprint, the rise of biobased surfactants is contributing to market expansion by satisfying both performance and sustainability needs in the agricultural sector.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=52947416

Based on application, the fungicides segment is anticipated to witness the highest growth in the market.

Fungicides within the agricultural surfactants sector are experiencing rapid growth driven by several key factors. Fungal diseases pose significant threats to both crop yields and quality, making effective management essential. Agricultural surfactants enhance fungicide performance by improving coverage, adhesion, and penetration on plant surfaces, providing thorough protection against fungal pathogens. As weather patterns shift and global trade increases, the risk of fungal outbreaks has grown, boosting the demand for reliable disease management solutions.

Moreover, the environmental and regulatory push for reduced chemical use complements the role of surfactants in optimizing fungicide efficiency. Their capacity for facilitating targeted and efficient applications aligns with sustainable farming practices. As the agricultural industry emphasizes precision and eco-friendly methods, fungicide-associated surfactants emerge as vital tools for addressing fungal diseases, driving their swift growth in the global market.

North America Set to Dominate Agricultural Surfactants Market Share

North America's leadership in the agricultural surfactants market stems from a combination of crucial factors. The region's advanced farming techniques and a strong focus on maximizing crop yields have significantly increased the demand for surfactants that improve the effectiveness of agrochemical applications. North American farmers and agribusinesses are pioneers in adopting innovative precision agriculture methods, which require accurate and efficient chemical application—something surfactants provide.

Additionally, the presence of major agrochemical and biotechnology firms in North America drives ongoing research and development, resulting in the continuous innovation of surfactant formulations designed for the region's varied crop and pest needs. Strict environmental regulations have further spurred the use of surfactants to minimize chemical waste and reduce environmental impact.

This robust growth is supported by the region's economic strength, technological advancements, and commitment to sustainable farming practices. Together, these elements solidify North America's position as a leader in the adoption of agricultural surfactants, enabling it to retain the largest market share in the global industry.

Top Agricultural Surfactants Companies

CHS Inc. (US), BASF SE (Germany), Solvay (Belgium), Corteva Agriscience (US), Evonik (Germany), Croda International Plc (UK), Nufarm (Australia), CLARIANT (Switzerland), and Stepan Company (US)are among the key players in the global market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and expanding their production facilities. The key strategies used by companies in the agricultural surfactants market include strategic acquisitions to gain a foothold over the extensive supply chain and new product launches as a result of extensive research and development (RD) initiatives.