Castor oil, a versatile and highly sought-after vegetable oil, is used across a wide range of industries, including cosmetics, pharmaceuticals, agriculture, and manufacturing. Known for its wide array of applications, from personal care products to industrial lubricants, castor oil has experienced fluctuating price trends due to various factors affecting its supply and demand. In this article, we will explore the key drivers influencing the castor oil price trend, historical price fluctuations, and provide insights into what the future holds for this essential commodity.

What Drives the Castor Oil Price Trend?

Several factors play a role in determining the price of castor oil. These factors include raw material costs, production practices, global demand, and environmental conditions. Below are some of the main drivers behind the price fluctuations in the castor oil market:

1. Raw Material Costs (Castor Beans)

The primary source of castor oil is castor beans, which are harvested from the castor plant (Ricinus communis). The price of castor oil is directly influenced by the price of castor beans, as they are the raw material used to produce the oil. Factors affecting the price of castor beans include:

- Weather Conditions: Castor beans are highly sensitive to climatic conditions, and adverse weather conditions such as droughts or floods can significantly impact the yield. A poor harvest can lead to a scarcity of beans, driving up the price of both the raw material and the oil extracted from it.

- Land Availability and Crop Yields: The amount of land allocated to castor bean farming and the productivity of those lands also influence supply levels. Countries with significant castor bean production—such as India, China, and Brazil—are essential for global supply. Any disruptions to these regions, such as political instability or farming inefficiencies, can affect the supply and, consequently, the price of castor oil.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/castor-oil-price-trends/pricerequest

2. Global Demand for Castor Oil and Its Derivatives

The price of castor oil is also heavily influenced by global demand, which varies depending on its many uses across different industries. Major drivers of demand include:

- Cosmetics and Personal Care: Castor oil is widely used in the cosmetics and personal care industry, primarily in skin creams, lotions, hair oils, and soaps. The rising demand for natural and organic products has driven growth in this sector, as castor oil is considered a natural alternative to synthetic ingredients.

- Pharmaceuticals: Castor oil is used in the pharmaceutical industry for its medicinal properties, including its role as a laxative and in the production of certain medications. The growing healthcare sector and increasing consumer interest in natural remedies are contributing to the increased demand for castor oil.

- Industrial Uses: Castor oil and its derivatives, such as derivatives of ricinoleic acid, are used in various industrial applications, including lubricants, paints, coatings, plastics, and biodiesel production. The demand for castor oil from the industrial sector has been growing due to the increasing preference for bio-based and environmentally friendly alternatives to petrochemical products.

- Agriculture: Castor oil is also used as a natural pesticide, which is gaining popularity among organic farmers. This growing demand for organic farming practices and natural pesticides is a contributing factor to the increased consumption of castor oil.

3. Supply Chain and Production Costs

The production of castor oil is labor-intensive and requires a well-established supply chain to ensure a steady flow of raw material to processing plants. The supply chain factors that affect the price of castor oil include:

- Transportation Costs: Castor oil is traded globally, and transportation costs play a significant role in its final price. Changes in fuel prices, transportation bottlenecks, or logistical disruptions can add to the overall cost of getting castor oil to international markets.

- Labor Costs: Castor oil production involves manual labor, especially during the harvest and processing stages. Rising labor costs in key producing countries can affect the production cost, which may, in turn, be passed on to consumers through higher oil prices.

- Processing and Extraction Costs: The method used to extract oil from castor beans, whether through cold pressing or solvent extraction, also influences production costs. Cold pressing is more labor-intensive and results in a higher quality oil, while solvent extraction is cheaper but may result in lower-quality oil. Changes in extraction techniques or technological advancements can impact production costs and, subsequently, the price of castor oil.

4. Regulatory and Policy Changes

Government policies and regulations in major producing countries can significantly impact castor oil prices. Some of the key policy drivers include:

- Subsidies and Tariffs: In countries like India, where a significant portion of global castor beans is grown, government subsidies for farmers or the imposition of export tariffs can affect the global supply of castor beans and oil. If governments restrict exports to ensure domestic supply, international prices may rise.

- Environmental Regulations: Stricter environmental regulations in major manufacturing hubs may increase production costs, particularly if manufacturers need to invest in cleaner production technologies or pay for carbon credits. The price of castor oil may reflect these additional costs, especially in countries with stricter environmental laws.

5. Currency Fluctuations

As castor oil is traded internationally, exchange rate fluctuations can influence its price. For instance, if the Indian Rupee (INR) weakens against the US Dollar (USD), the price of castor oil in international markets may increase, as a weaker INR means that exporters need to charge more in order to maintain profitability.

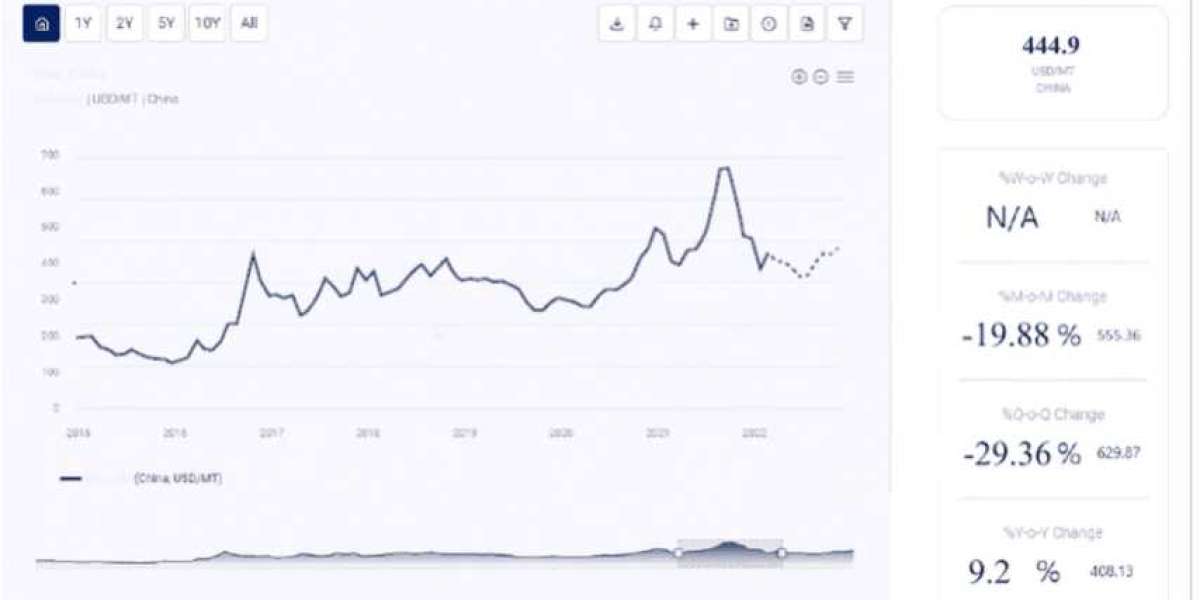

Historical Castor Oil Price Trends

The price of castor oil has seen significant fluctuations over the years, largely driven by the interplay of supply and demand dynamics, weather events, and global economic conditions. Here's a look at how prices have trended historically:

2018-2020: Price Volatility Due to Supply Shortages

From 2018 to 2020, the global price of castor oil experienced volatility due to supply shortages, largely caused by adverse weather conditions in India, one of the largest producers of castor beans. Droughts and erratic weather led to reduced harvests and a higher cost of production, resulting in price increases. Additionally, the global demand for castor oil remained robust, especially from the cosmetics and pharmaceutical sectors, contributing to price hikes during this period.

2021-2022: Price Stabilization Amid Post-Pandemic Recovery

In 2021 and 2022, castor oil prices began to stabilize as global markets recovered from the effects of the COVID-19 pandemic. While transportation and logistical issues still caused occasional supply chain disruptions, the market saw a return to pre-pandemic levels in terms of production and demand. The increased use of castor oil in the personal care and pharmaceuticals industries contributed to a steady rise in prices, but not to the same extent as in the previous years.

2023-Present: Price Fluctuations Driven by Inflation and Global Supply Chain Challenges

In 2023, castor oil prices began to climb again due to global inflationary pressures, rising labor costs, and continued supply chain disruptions. Geopolitical tensions, such as those in key producing regions, also affected market stability. As oil prices increased and the demand for sustainable and bio-based products grew, castor oil prices saw upward pressure.

Castor Oil Price Forecast: What to Expect in the Coming Years

Looking forward, the castor oil market is expected to continue experiencing price fluctuations, influenced by a variety of factors. However, there are some trends and developments that could shape the future trajectory of castor oil prices.

1. Continued Growth in Demand for Sustainable Products

The global shift towards sustainability is expected to increase demand for castor oil, particularly from industries looking to replace petrochemical-based products with bio-based alternatives. As more companies and consumers opt for natural ingredients in cosmetics and personal care products, the demand for castor oil is expected to remain strong, potentially leading to higher prices in the long term.

2. Climate Change and Crop Yields

Climate change is likely to have a long-term impact on crop yields, as extreme weather events continue to threaten agricultural production. Droughts, floods, and shifting weather patterns in key castor-producing regions like India and Brazil could lead to supply disruptions, driving up the price of castor oil. In the coming years, this could lead to more frequent price fluctuations.

3. Technological Advancements in Production

Advancements in farming techniques and oil extraction technologies could help reduce production costs and stabilize prices. If new farming methods increase the yield of castor beans or if more cost-effective extraction methods are developed, the price of castor oil could become less volatile in the future.

4. Economic Factors and Global Trade

Economic factors, including inflation, currency fluctuations, and trade policies, will continue to impact the global price of castor oil. If key producers like India and China implement export restrictions or adjust tariffs, the price of castor oil could rise globally. Additionally, economic recovery or recession could influence demand for industrial and cosmetic products, indirectly impacting castor oil prices.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Castor oil, a versatile and highly sought-after vegetable oil, is used across a wide range of industries, including cosmetics, pharmaceuticals, agriculture, and manufacturing. Known for its wide array of applications, from personal care products to industrial lubricants, castor oil has experienced fluctuating price trends due to various factors affecting its supply and demand. In this article, we will explore the key drivers influencing the castor oil price trend, historical price fluctuations, and provide insights into what the future holds for this essential commodity.

What Drives the Castor Oil Price Trend?

Several factors play a role in determining the price of castor oil. These factors include raw material costs, production practices, global demand, and environmental conditions. Below are some of the main drivers behind the price fluctuations in the castor oil market:

1. Raw Material Costs (Castor Beans)

The primary source of castor oil is castor beans, which are harvested from the castor plant (Ricinus communis). The price of castor oil is directly influenced by the price of castor beans, as they are the raw material used to produce the oil. Factors affecting the price of castor beans include:

- Weather Conditions: Castor beans are highly sensitive to climatic conditions, and adverse weather conditions such as droughts or floods can significantly impact the yield. A poor harvest can lead to a scarcity of beans, driving up the price of both the raw material and the oil extracted from it.

- Land Availability and Crop Yields: The amount of land allocated to castor bean farming and the productivity of those lands also influence supply levels. Countries with significant castor bean production—such as India, China, and Brazil—are essential for global supply. Any disruptions to these regions, such as political instability or farming inefficiencies, can affect the supply and, consequently, the price of castor oil.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/castor-oil-price-trends/pricerequest

2. Global Demand for Castor Oil and Its Derivatives

The price of castor oil is also heavily influenced by global demand, which varies depending on its many uses across different industries. Major drivers of demand include:

- Cosmetics and Personal Care: Castor oil is widely used in the cosmetics and personal care industry, primarily in skin creams, lotions, hair oils, and soaps. The rising demand for natural and organic products has driven growth in this sector, as castor oil is considered a natural alternative to synthetic ingredients.

- Pharmaceuticals: Castor oil is used in the pharmaceutical industry for its medicinal properties, including its role as a laxative and in the production of certain medications. The growing healthcare sector and increasing consumer interest in natural remedies are contributing to the increased demand for castor oil.

- Industrial Uses: Castor oil and its derivatives, such as derivatives of ricinoleic acid, are used in various industrial applications, including lubricants, paints, coatings, plastics, and biodiesel production. The demand for castor oil from the industrial sector has been growing due to the increasing preference for bio-based and environmentally friendly alternatives to petrochemical products.

- Agriculture: Castor oil is also used as a natural pesticide, which is gaining popularity among organic farmers. This growing demand for organic farming practices and natural pesticides is a contributing factor to the increased consumption of castor oil.

3. Supply Chain and Production Costs

The production of castor oil is labor-intensive and requires a well-established supply chain to ensure a steady flow of raw material to processing plants. The supply chain factors that affect the price of castor oil include:

- Transportation Costs: Castor oil is traded globally, and transportation costs play a significant role in its final price. Changes in fuel prices, transportation bottlenecks, or logistical disruptions can add to the overall cost of getting castor oil to international markets.

- Labor Costs: Castor oil production involves manual labor, especially during the harvest and processing stages. Rising labor costs in key producing countries can affect the production cost, which may, in turn, be passed on to consumers through higher oil prices.

- Processing and Extraction Costs: The method used to extract oil from castor beans, whether through cold pressing or solvent extraction, also influences production costs. Cold pressing is more labor-intensive and results in a higher quality oil, while solvent extraction is cheaper but may result in lower-quality oil. Changes in extraction techniques or technological advancements can impact production costs and, subsequently, the price of castor oil.

4. Regulatory and Policy Changes

Government policies and regulations in major producing countries can significantly impact castor oil prices. Some of the key policy drivers include:

- Subsidies and Tariffs: In countries like India, where a significant portion of global castor beans is grown, government subsidies for farmers or the imposition of export tariffs can affect the global supply of castor beans and oil. If governments restrict exports to ensure domestic supply, international prices may rise.

- Environmental Regulations: Stricter environmental regulations in major manufacturing hubs may increase production costs, particularly if manufacturers need to invest in cleaner production technologies or pay for carbon credits. The price of castor oil may reflect these additional costs, especially in countries with stricter environmental laws.

5. Currency Fluctuations

As castor oil is traded internationally, exchange rate fluctuations can influence its price. For instance, if the Indian Rupee (INR) weakens against the US Dollar (USD), the price of castor oil in international markets may increase, as a weaker INR means that exporters need to charge more in order to maintain profitability.

Historical Castor Oil Price Trends

The price of castor oil has seen significant fluctuations over the years, largely driven by the interplay of supply and demand dynamics, weather events, and global economic conditions. Here's a look at how prices have trended historically:

2018-2020: Price Volatility Due to Supply Shortages

From 2018 to 2020, the global price of castor oil experienced volatility due to supply shortages, largely caused by adverse weather conditions in India, one of the largest producers of castor beans. Droughts and erratic weather led to reduced harvests and a higher cost of production, resulting in price increases. Additionally, the global demand for castor oil remained robust, especially from the cosmetics and pharmaceutical sectors, contributing to price hikes during this period.

2021-2022: Price Stabilization Amid Post-Pandemic Recovery

In 2021 and 2022, castor oil prices began to stabilize as global markets recovered from the effects of the COVID-19 pandemic. While transportation and logistical issues still caused occasional supply chain disruptions, the market saw a return to pre-pandemic levels in terms of production and demand. The increased use of castor oil in the personal care and pharmaceuticals industries contributed to a steady rise in prices, but not to the same extent as in the previous years.

2023-Present: Price Fluctuations Driven by Inflation and Global Supply Chain Challenges

In 2023, castor oil prices began to climb again due to global inflationary pressures, rising labor costs, and continued supply chain disruptions. Geopolitical tensions, such as those in key producing regions, also affected market stability. As oil prices increased and the demand for sustainable and bio-based products grew, castor oil prices saw upward pressure.

Castor Oil Price Forecast: What to Expect in the Coming Years

Looking forward, the castor oil market is expected to continue experiencing price fluctuations, influenced by a variety of factors. However, there are some trends and developments that could shape the future trajectory of castor oil prices.

1. Continued Growth in Demand for Sustainable Products

The global shift towards sustainability is expected to increase demand for castor oil, particularly from industries looking to replace petrochemical-based products with bio-based alternatives. As more companies and consumers opt for natural ingredients in cosmetics and personal care products, the demand for castor oil is expected to remain strong, potentially leading to higher prices in the long term.

2. Climate Change and Crop Yields

Climate change is likely to have a long-term impact on crop yields, as extreme weather events continue to threaten agricultural production. Droughts, floods, and shifting weather patterns in key castor-producing regions like India and Brazil could lead to supply disruptions, driving up the price of castor oil. In the coming years, this could lead to more frequent price fluctuations.

3. Technological Advancements in Production

Advancements in farming techniques and oil extraction technologies could help reduce production costs and stabilize prices. If new farming methods increase the yield of castor beans or if more cost-effective extraction methods are developed, the price of castor oil could become less volatile in the future.

4. Economic Factors and Global Trade

Economic factors, including inflation, currency fluctuations, and trade policies, will continue to impact the global price of castor oil. If key producers like India and China implement export restrictions or adjust tariffs, the price of castor oil could rise globally. Additionally, economic recovery or recession could influence demand for industrial and cosmetic products, indirectly impacting castor oil prices.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

What Drives the Castor Oil Price Trend?

Several factors play a role in determining the price of castor oil. These factors include raw material costs, production practices, global demand, and environmental conditions. Below are some of the main drivers behind the price fluctuations in the castor oil market:

1. Raw Material Costs (Castor Beans)

The primary source of castor oil is castor beans, which are harvested from the castor plant (Ricinus communis). The price of castor oil is directly influenced by the price of castor beans, as they are the raw material used to produce the oil. Factors affecting the price of castor beans include:

- Weather Conditions: Castor beans are highly sensitive to climatic conditions, and adverse weather conditions such as droughts or floods can significantly impact the yield. A poor harvest can lead to a scarcity of beans, driving up the price of both the raw material and the oil extracted from it.

- Land Availability and Crop Yields: The amount of land allocated to castor bean farming and the productivity of those lands also influence supply levels. Countries with significant castor bean production—such as India, China, and Brazil—are essential for global supply. Any disruptions to these regions, such as political instability or farming inefficiencies, can affect the supply and, consequently, the price of castor oil.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/castor-oil-price-trends/pricerequest

2. Global Demand for Castor Oil and Its Derivatives

The price of castor oil is also heavily influenced by global demand, which varies depending on its many uses across different industries. Major drivers of demand include:

- Cosmetics and Personal Care: Castor oil is widely used in the cosmetics and personal care industry, primarily in skin creams, lotions, hair oils, and soaps. The rising demand for natural and organic products has driven growth in this sector, as castor oil is considered a natural alternative to synthetic ingredients.

- Pharmaceuticals: Castor oil is used in the pharmaceutical industry for its medicinal properties, including its role as a laxative and in the production of certain medications. The growing healthcare sector and increasing consumer interest in natural remedies are contributing to the increased demand for castor oil.

- Industrial Uses: Castor oil and its derivatives, such as derivatives of ricinoleic acid, are used in various industrial applications, including lubricants, paints, coatings, plastics, and biodiesel production. The demand for castor oil from the industrial sector has been growing due to the increasing preference for bio-based and environmentally friendly alternatives to petrochemical products.

- Agriculture: Castor oil is also used as a natural pesticide, which is gaining popularity among organic farmers. This growing demand for organic farming practices and natural pesticides is a contributing factor to the increased consumption of castor oil.

3. Supply Chain and Production Costs

The production of castor oil is labor-intensive and requires a well-established supply chain to ensure a steady flow of raw material to processing plants. The supply chain factors that affect the price of castor oil include:

- Transportation Costs: Castor oil is traded globally, and transportation costs play a significant role in its final price. Changes in fuel prices, transportation bottlenecks, or logistical disruptions can add to the overall cost of getting castor oil to international markets.

- Labor Costs: Castor oil production involves manual labor, especially during the harvest and processing stages. Rising labor costs in key producing countries can affect the production cost, which may, in turn, be passed on to consumers through higher oil prices.

- Processing and Extraction Costs: The method used to extract oil from castor beans, whether through cold pressing or solvent extraction, also influences production costs. Cold pressing is more labor-intensive and results in a higher quality oil, while solvent extraction is cheaper but may result in lower-quality oil. Changes in extraction techniques or technological advancements can impact production costs and, subsequently, the price of castor oil.

4. Regulatory and Policy Changes

Government policies and regulations in major producing countries can significantly impact castor oil prices. Some of the key policy drivers include:

- Subsidies and Tariffs: In countries like India, where a significant portion of global castor beans is grown, government subsidies for farmers or the imposition of export tariffs can affect the global supply of castor beans and oil. If governments restrict exports to ensure domestic supply, international prices may rise.

- Environmental Regulations: Stricter environmental regulations in major manufacturing hubs may increase production costs, particularly if manufacturers need to invest in cleaner production technologies or pay for carbon credits. The price of castor oil may reflect these additional costs, especially in countries with stricter environmental laws.

5. Currency Fluctuations

As castor oil is traded internationally, exchange rate fluctuations can influence its price. For instance, if the Indian Rupee (INR) weakens against the US Dollar (USD), the price of castor oil in international markets may increase, as a weaker INR means that exporters need to charge more in order to maintain profitability.

Historical Castor Oil Price Trends

The price of castor oil has seen significant fluctuations over the years, largely driven by the interplay of supply and demand dynamics, weather events, and global economic conditions. Here's a look at how prices have trended historically:

2018-2020: Price Volatility Due to Supply Shortages

From 2018 to 2020, the global price of castor oil experienced volatility due to supply shortages, largely caused by adverse weather conditions in India, one of the largest producers of castor beans. Droughts and erratic weather led to reduced harvests and a higher cost of production, resulting in price increases. Additionally, the global demand for castor oil remained robust, especially from the cosmetics and pharmaceutical sectors, contributing to price hikes during this period.

2021-2022: Price Stabilization Amid Post-Pandemic Recovery

In 2021 and 2022, castor oil prices began to stabilize as global markets recovered from the effects of the COVID-19 pandemic. While transportation and logistical issues still caused occasional supply chain disruptions, the market saw a return to pre-pandemic levels in terms of production and demand. The increased use of castor oil in the personal care and pharmaceuticals industries contributed to a steady rise in prices, but not to the same extent as in the previous years.

2023-Present: Price Fluctuations Driven by Inflation and Global Supply Chain Challenges

In 2023, castor oil prices began to climb again due to global inflationary pressures, rising labor costs, and continued supply chain disruptions. Geopolitical tensions, such as those in key producing regions, also affected market stability. As oil prices increased and the demand for sustainable and bio-based products grew, castor oil prices saw upward pressure.

Castor Oil Price Forecast: What to Expect in the Coming Years

Looking forward, the castor oil market is expected to continue experiencing price fluctuations, influenced by a variety of factors. However, there are some trends and developments that could shape the future trajectory of castor oil prices.

1. Continued Growth in Demand for Sustainable Products

The global shift towards sustainability is expected to increase demand for castor oil, particularly from industries looking to replace petrochemical-based products with bio-based alternatives. As more companies and consumers opt for natural ingredients in cosmetics and personal care products, the demand for castor oil is expected to remain strong, potentially leading to higher prices in the long term.

2. Climate Change and Crop Yields

Climate change is likely to have a long-term impact on crop yields, as extreme weather events continue to threaten agricultural production. Droughts, floods, and shifting weather patterns in key castor-producing regions like India and Brazil could lead to supply disruptions, driving up the price of castor oil. In the coming years, this could lead to more frequent price fluctuations.

3. Technological Advancements in Production

Advancements in farming techniques and oil extraction technologies could help reduce production costs and stabilize prices. If new farming methods increase the yield of castor beans or if more cost-effective extraction methods are developed, the price of castor oil could become less volatile in the future.

4. Economic Factors and Global Trade

Economic factors, including inflation, currency fluctuations, and trade policies, will continue to impact the global price of castor oil. If key producers like India and China implement export restrictions or adjust tariffs, the price of castor oil could rise globally. Additionally, economic recovery or recession could influence demand for industrial and cosmetic products, indirectly impacting castor oil prices.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA