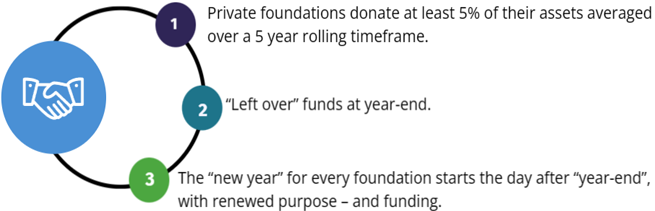

“Year-end” is the time that funders must ensure that they have met their minimum required donation amounts to qualified donees. The Internal Revenue Service requires that private foundations donate at least 5% of their assets averaged over a 5 year rolling timeframe. If they have not met this donation threshold, they will most likely be looking to meet it before their year-end. This presents an grant seeker opportunity for charities to apply at an advantageous time.

Even if foundations have met their minimum giving thresholds, “left over” funds at year-end can leave the impression that those in charge of the grant making process have been unsuccessful in their efforts to locate a worthy recipient. This also presents an opportunity for the grant seeker.

The “new year” for every foundation starts the day after “year-end”, with renewed purpose – and funding. All donation budgets and plans are refreshed and await a new cycle of funding requests, decisions and grant awards. The sooner the grant seeker approaches the foundation after the start of their new year, the better the chances are that foundatiom funding will be available.

So why did I title this blog “the January Effect”? Because December and January see more foundations ending their fiscal years and starting their new ones than any other months in the year. Of the 122,345 foundations contained in FoundationSearch, 87,424 have their year-end during this period.

Read More : Funding Services