Hand Protection Equipment Industry Overview

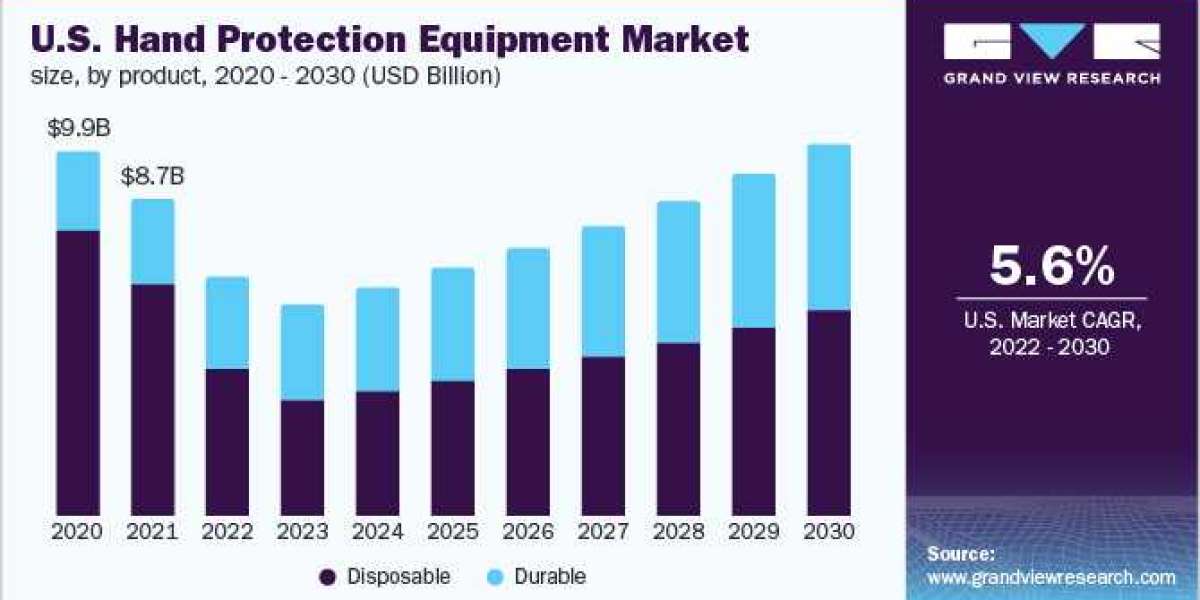

The global hand protection equipment market size was estimated at USD 29.6 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2030. The rising demand is attributed to the increasing concerns about hand hygiene and the product's efficiency in limiting the spread of COVID-19 in various end-use industries. The onset of the second wave of COVID-19 led to the shortage of hand protection equipment in hospitals and other sectors, such as manufacturing and construction. Various manufacturers started expanding their production at the end of 2020, thereby eliminating the demand-supply gap.

Gather more insights about the market drivers, restrains and growth of the Hand Protection Equipment Market

Economies that have been hit hard by the COVID-19 pandemic, such as the United States, have implemented specific regulations like the Defense Production Act (DPA), which provides local enterprises the duty of manufacturing hand protective equipment for healthcare professionals. Strict government regulations regarding the health and safety of doctors, nurses, and working professionals, coupled with a rise in COVID-19 cases, have prompted workers to use these products for protection against any kind of health hazards and healthcare-associated infections. Several government authorities, such as the Centers for Disease Control and Prevention, issued guidelines regarding the use of sterile barrier precautions, such as the use of hand protection equipment.

These gloves have excellent chemical and tear resistance, tactility, flexibility, which makes them ideal for use in areas where there is direct contact with chemicals, microbes, and physiological fluids. The industry is an amalgamation of global and regional players having a broad portfolio of products, which restricts new players from entering the market. Amidst the pandemic, the U.S. government administration sustained the Defense Production Act (DFA) to increase the production of medical gloves and other such products to reduce their dependency on foreign countries.

Browse through Grand View Research's Smart Textiles Industry Research Reports.

- The global industrial protective footwear market size was estimated at USD 10.76 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030.

- The global personal protective equipment market size was over USD 79.53 billion in 2023 and is anticipated to grow at a CAGR of 7.2% from 2024 to 2030.

Key Companies Market Share Insights

Major players are undertaking strategies, such as product development and distribution, and network expansion, to gain a higher share in the industry. For instance, in August 2020, Ansell Ltd. signed a distribution partnership with OneMed, a provider of medical supplies and support systems, with an existing distribution network in the Nordics. Manufacturers have also started expanding their businesses through mergers, acquisitions, and geographical expansions. For instance, in December 2021, Top Glove Corp. Bhd. announced expanding its production capacity to meet the global demand for gloves through strengthening its presence in key strategic markets, technological improvements to drive product innovation production efficiency, as well as broadening its product portfolio to adjacent other non-glove products. Some prominent players in the global hand protection equipment market include:

- Top Glove Corp. Bhd.

- Hartalega Holdings Berhad

- Superior Gloves

- Adenna LLC

- MCR Safety

- Atlantic Safety Products, Inc.

- Ammex Corp.

- Kimberly-Clark Corp.

- Sempermed USA, Inc.

- Halyard Health, Inc

Order a free sample PDF of the Hand Protection Equipment Market Study, published by Grand View Research.