Pulse Lavage Industry Overview

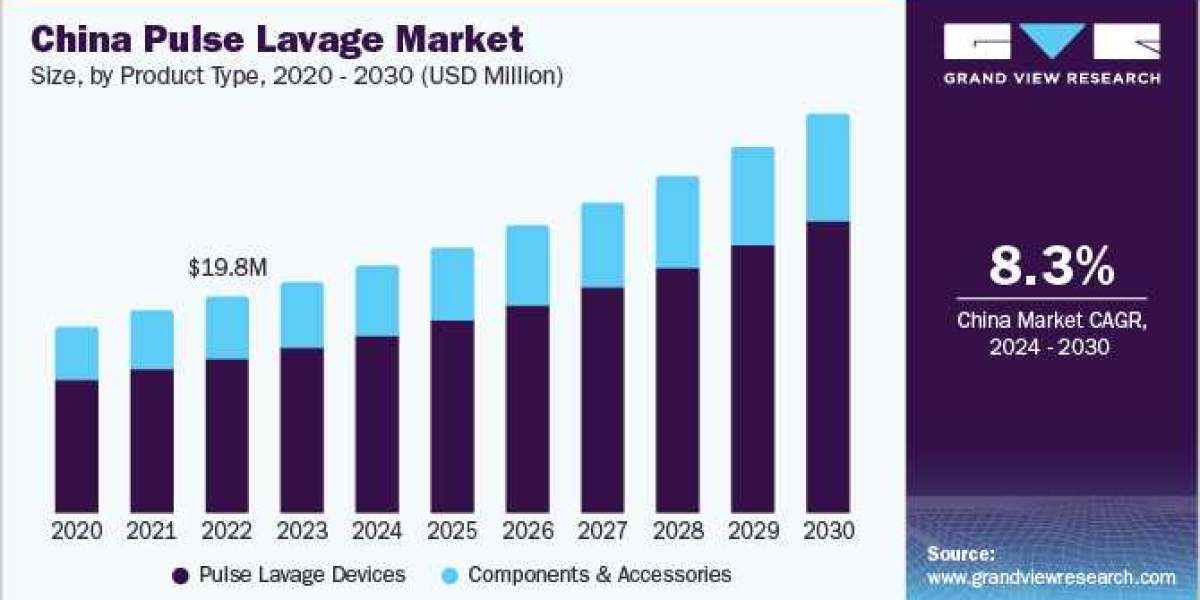

The global pulse lavage market size was estimated at USD 492.15 million in 2023 and is projected to grow at a CAGR of 7.53% from 2024 to 2030.

The increasing number of orthopedic surgeries globally is expected to drive the market growth. As per a report by the Baishideng Publishing Group Inc., in August 2023, China performs over 50,000 hip or knee joint replacement surgeries annually. Moreover, as per a report by the Canadian Institute for Health Information, in 2022-2021, about 110,000 joint replacement surgeries were performed in Canada.

Pulse lavage is used to clean and debride wounds or surgical sites, particularly in orthopedic operations, by delivering pressurized saline. This technique is crucial for preventing infections and ensuring the success of surgical interventions, especially in procedures involving implants or complex reconstructions. Moreover, the rising prevalence of orthopedic conditions, such as Osteoarthritis (OA), rheumatoid arthritis, and trauma-related injuries, is expected to drive the demand for orthopedic surgeries.

Gather more insights about the market drivers, restrains and growth of the Pulse Lavage Market

The increase in the aging population, there is a higher prevalence of conditions that require surgical interventions and subsequent wound care, propelling the pulse lavage market growth. According to the WHO, by 2050, global population aged 60 years and above is estimated to total 2 billion. Moreover, 80% of all elderly population will live in low - middle-income nations by 2050. Older adults are more prone to falls and fractures due to decreased bone density, balance issues, and other age-related health concerns. These incidents often lead to traumatic injuries requiring surgical intervention, where pulse lavage systems are crucial for debridement and cleaning of the surgical site, reducing the risk of infection and improving surgical outcomes.

Besides, the aging population is more susceptible to chronic conditions, such as osteoarthritis and diabetes, which can lead to complications requiring surgical treatment. In such cases, pulse lavage systems are utilized to ensure thorough cleaning of wounds and surgical areas to promote healing and prevent infections. These factors are expected to drive the market growth over the forecast period.

Technological advancements in pulse lavage systems have significantly influenced market dynamics, driving the demand and adoption across healthcare settings. These advancements cater primarily to enhancing surgical outcomes, reducing infection rates, and improving the efficiency of surgical procedures. Modern pulse lavage systems are designed for optimal debridement efficiency. They offer adjustable pressure settings to cater to different surgical needs, allowing for the gentle removal of necrotic tissue, bacteria, contaminants from wounds and surgical sites without damaging healthy tissue. This precision contributes to better surgical outcomes and a reduced risk of infection.

Moreover, the introduction of battery-operated and cordless pulse lavage systems has enhanced their portability convenience, allowing for their use in various settings, including emergency rooms, field hospitals, and in situations where mobility is crucial. This flexibility has broadened the utility and appeal of pulse lavage systems. For instance, in August 2022, Heraeus Medical launched the innovative palaJet pulse lavage system, a powerful, battery-powered, disposable device designed to effectively clean bone beds. The palaJet system offers simple operation, with adjustable irrigation pressure to enhance cleaning outcomes. In addition, its suction feature facilitates the removal of surplus tissue and fluids.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- The global pharmaceutical regulatory affairs market size was estimated at USD 8.84 billion in 2023 and is projected to grow at a CAGR of 7.16% from 2024 to 2030.

- The global neuroprosthetics market size was valued at USD 12.71 billion in 2023 and is projected to grow at a CAGR of 15.6% from 2024 to 2030.

Key Pulse Lavage Company Insights

Stryker Corporation; Zimmer Biomet Holdings, Inc; Heraeus Holding are some of the major players in the pulse lavage market. These established players have a broad range of products and a global distribution network. Emerging players and startups are also entering the market with innovative solutions, challenging the status quo, and pushing for technological advancements.

Companies are investing in RD to introduce systems with enhanced features such as adjustable pressure settings, ergonomic designs, portable units, and systems that integrate seamlessly with other surgical tools. Innovations also include disposable options to ensure sterility and reduce the risk of infection, as well as environmentally friendly options that minimize waste.

Key Pulse Lavage Companies:

The following are the leading companies in the pulse lavage market. These companies collectively hold the largest market share and dictate industry trends

- Stryker

- Zimmer Biomet Holdings, Inc.

- Mölnlycke Health Care AB

- BD

- Summit Medical Group Ltd (VillageMD)

- Apex Tools Orthopedics Co., a Colson Medical

- MicroAire Surgical Instruments LLC

- Judd Medical Ltd.

- Heraeus Medical GmbH

- Summit Medical Group Ltd (VillageMD)

- De Soutter Medical

- Caleb

Recent Developments

- In November 2023, Sonoma Pharmaceuticals, Inc. launched its next generation advanced intraoperative pulse lavage irrigation treatment in the U.S

- In August 2022, Heraeus Medical introduced the innovative palaJet, a battery-operated, single-use pulse lavage system designed for efficient and effective bone bed cleaning. Particularly in arthroplasty procedures, this crucial step contributes to improved long-term outcomes by thoroughly removing of fat residues, bone debris, marrow, and blood from cement-receiving surfaces.

- In January 2021, Stryker’s acquisition of OrthoSensor, a specialist in smart sensor technologies, is expected to significantly impact the orthopedic industry, particularly joint replacement. This integration will likely lead to the development and implementation of advanced smart sensor technologies, such as intraoperative sensors, wearables, and smart implants, to improve patient outcomes and satisfaction.

- In December 2020, Mölnlycke unveiled the launch of a new distribution center in the UK. This strategic move aims to improve customers' access to high-quality Mölnlycke products by establishing a more robust and efficient supply chain. In addition, this initiative promotes environmental benefits by optimizing the distribution process, ultimately reducing the environmental impact.

Order a free sample PDF of the Pulse Lavage Market Study, published by Grand View Research.