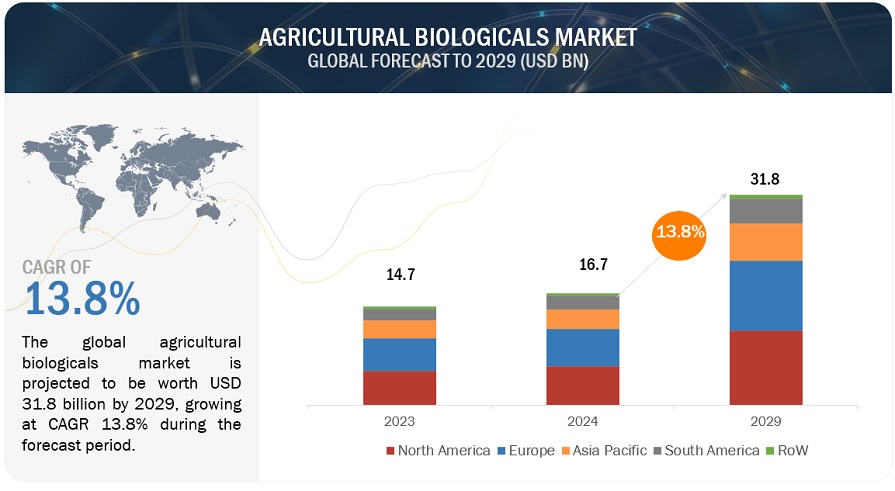

The agricultural biologicals industry is estimated at USD 16.7 billion in 2024 and is projected to reach USD 31.8 billion by 2029, at a CAGR of 13.8% from 2024 to 2029. The environment is becoming more and more concerned about the effect of conventional chemical-based agriculture; hence, there is a move toward sustainable farming practices. Agricultural biologicals include biopesticides, biofertilizers, and biostimulants, which are all eco-friendly alternatives. The overuse of chemical pesticides led to the development of resistance to these chemicals in many pests and pathogens. The biologicals in agriculture, in this context, provide alternative modes of action that can be used in integrated pest management programs to reduce the risk of resistance.

Agricultural Biologicals Market Trends:

Here are some current trends in the agricultural biologicals market:

1. Growing Adoption of Sustainable Practices: Farmers are increasingly turning to agricultural biologicals to reduce chemical usage and enhance sustainability. Biologicals, such as biopesticides and biofertilizers, are seen as eco-friendly alternatives to conventional chemicals.

2. Advancements in Technology: The development of new technologies, such as microbial genetics and synthetic biology, is driving innovation in agricultural biologicals. These advancements are improving the efficacy and specificity of biological products.

3. Integration with Precision Agriculture: Agricultural biologicals are being integrated with precision agriculture technologies. This combination allows for targeted application, improving efficiency and reducing waste.

4. Rise in Organic Farming: The growth of organic farming is boosting the demand for agricultural biologicals. Organic farms rely heavily on biologicals for pest control and soil health.

5. Investment in Research and Development: There is a significant increase in investment in RD for agricultural biologicals. Companies are focusing on developing new products and improving existing ones to meet the evolving needs of farmers.

6. Regulatory Support: Governments and regulatory bodies are providing support for the use of biologicals through favorable policies and streamlined approval processes, which is encouraging their adoption.

7. Consumer Demand for Sustainable Food: Increasing consumer demand for sustainably produced food is driving the market for agricultural biologicals. Consumers are looking for products that are produced with minimal environmental impact.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=100393324

semiochemical-based agricultural biologicals are projected to experience the highest CAGR throughout the forecast period.

Semiochemicals are a class of naturally occurring compounds that can affect the behavior of pests by interfering with their mating, feeding, or any other communicating process. Unlike conventional pesticides, semiochemicals only have negative actions on target pests and do not impact helpful insects and the surrounding environments; hence, they are efficient tools in integrated pest management programs. Also, the increasing adoption of IPM practices, coupled with growing precision needs in pest control, fuels the demand for semiochemicals. The improvement of formulation technologies that better guarantee stability and delivery will further enhance the growth of the semiochemicals market. Some of the key benefits associated with semiochemicals that make them rapidly adaptable in most agricultural settings include pest resistance reduction and the possibility of long-term pest control solutions.

Fruits vegetables are projected to experience the highest CAGR in the crop type segment throughout the forecast period.

Farmers are increasingly turning to agri-biologicals to protect their crops, as even minor damage can lead to significant economic losses. Also, most fruits and vegetables have a much faster growth cycle; accordingly, protection from pests and diseases demands more frequent and precise measures, which are provided by agri-biologicals. The perishability and quality requirements of fruits and vegetables also drive the adoption of biologicals that offer residue-free solutions and comply with strict safety and quality standards in both domestic and export markets. Moreover, the intensive cultivation practices involved in fruit and vegetable production create a higher demand for effective biological solutions in order to maintain yield and quality.

The North American agricultural biologicals market is projected to experience the highest CAGR throughout the forecast period.

The key market participants, coupled with the continuous launch of newer and more advanced biological products with applications in local agriculture, are driving this growth. Besides, the well-developed regulatory pathways in North America help in faster approval and adoption of new products. Large-scale commercial farming in the region focuses on higher yields with lesser resistance development in pests and diseases, raising demand for new-age agricultural biologicals. This, therefore, boosts the market through increased adoption of precision agriculture technologies in North America, hence the better application and resulting efficacy of biologicals.

Agricultural Biologicals Companies

The key players in the agricultural biologicals market include BASF SE (Germany), Syngenta Group (Switzerland), Bayer AG (Germany), FMC Corporation (US), Corteva (US), UPL (India), Nufarm (Australia), Novozymes A/S (Denmark), Lallemand Inc (Canada), Mosaic (US), Rovensa Next (Spain), Sumitomo Chemical Co., Ltd (Japan), SEIPASA, S.A. (Spain), Koppert (Netherlands), and Gowan Company (US). These market participants are emphasizing the expansion of their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.